* Euro on back foot ahead of ECB policy meeting

* European stocks up 0.4 percent, bond yields nudge up

* Dollar near 12-1/2-year high after Fed hike talk

* Precious and industrial metals languish

By Marc Jones

LONDON, Dec 3 (Reuters) - Investors were hoping for another

bit of Mario Draghi magic on Thursday, after risk assets were

left bruised by comments from the head of the Federal Reserve

that she was "looking forward" to hiking U.S. rates.

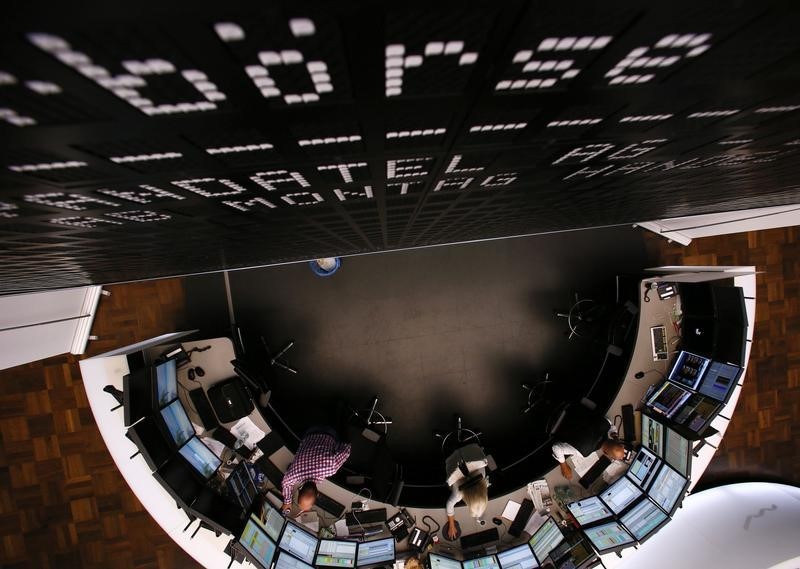

European stocks .FTEU3 were 0.4 percent higher and the

euro EUR= was hovering near a 7-1/2-year low with Draghi

expected to expand the European Central Bank's money printing

programme later and cut its deposit rate again.

It followed a fresh spurt by the dollar .DXY overnight

that had sent gold XAU= to a new 5-1/2-year low and other

commodity and emerging markets .MSCIEF tumbling again.

The move had been triggered by Fed head Janet Yellen who had

said on Wednesday that raising U.S. rates, something it is

expected to do for the first time in nearly a decade on Dec. 16,

would be proof of the economy's recovery.

"When the Committee begins to normalize the stance of

policy, doing so will be a testament ... to how far our economy

has come," she said, referring to the Fed's policy-setting

committee. "In that sense, it is a day that I expect we all are

looking forward to."

It left the focus firmly on the ECB's moves later and

traders wondering whether whatever comes out of Frankfurt will

be able to offset the impact of higher Fed interest rates, which

tend to drive borrowing costs globally.

"Draghi is going to have to keep doing what he can," said

Didier Saint-Georges, managing director of fund manager

Carmignac.

"But the impact of central banks is meeting the wall of

diminishing returns... so he will have to do more and more and

more and even then it won't have the same effect."

The ECB will announce its decision on rates at 1245 GMT and

any new bond buying plans at its 1330 GMT news conference.

Money markets are pricing in a cut of at least 10 basis

points in the ECB deposit rate to minus 30 basis points, while

economists in a Reuters poll expect an increase in asset buying

to 75 billion euros a month from 60 billion euros.

Short-term German yields were pinned near record lows in

deep negative territory as the expectations mounted.

Longer-dated 10-year yields were marginally higher across the

region though having been dragged up by Yellen and U.S. yields.

COMMODITIES CRUNCHED

The euro fell 0.6 percent to $1.0553, while the

dollar index .DXY , which measures the greenback against 6 top

world currencies, was hovering just below a 12-1/2-year high of

100.51 .DXY it had hit overnight.

In Asia, shares had been under pressure after a sharp fall

on Wall Street on Tuesday. MSCI's main regional index ex Japan

.MIAPJ0000PUS fell 0.4 percent as Tokyo's Nikkei .N225 also

ending flat. .T

Australian shares .AXJO fell 0.6 percent and South

Korea's Kospi .KS11 shed 1 percent. Shares in Hong Kong,

Malaysia and Singapore also declined although Shanghai

brushed off disappointing services sector data to close 0.7

percent higher.

In commodities, crude oil bounced modestly on bargain

hunting following its tumble overnight prompted by surging U.S.

stockpiles and the stronger dollar.

U.S. crude CLc1 was up 1.2 percent at $40.43 a barrel

after dropping 4 percent overnight. Crude was still capped with

OPEC widely expected not to opt for a production cut at Friday's

meeting despite a global supply glut.

Industrial metals also remained under pressure amid global

oversupply and shrinking Chinese demand, with spot iron ore

prices plumbing 10-year lows this week.

Copper on the London Metal Exchange was down 0.5

percent at $4,540.50 a tonne as it edged back towards a 6-year

low as this week's pleas for Chinese government intervention

providing little tonic.

(Additional Reporting by Shinichi Saoshiro in Tokyo; Editing by

Toby Chopra)