* China shares bounce, Beijing pledges vigorous fiscal steps

* Longer-term bond yields up globally, focus on BOJ

* Talk U.S. GDP report on Friday could beat forecasts

* Alphabet shares to jump to record as results impress

* Jump in metals prices also lift resource stocks

* Turkish markets battered as c.bank shies away from rate hike

* Graphic: World FX rates in 2018 http://tmsnrt.rs/2egbfVh

By Marc Jones

LONDON, July 24 (Reuters) - World shares hit their highest in a month on Tuesday, as China promised fiscal action to support the world's second-largest economy and stellar results from internet giant Alphabet underpinned tech stocks.

Wall Street was set for a short climb when it reopens, with Google-parent Alphabet, part of the so-called FAANG stocks, expected to jump almost 5 percent after a better-than-expected quarterly revenue jump.

Metals prices were also sharply higher thanks to the stimulus signals in Beijing .N , while global bonds were still sluggish following speculation that the Bank of Japan may soon trim its massive stimulus.

The euro EUR=EBS had nosed higher on solid German manufacturing data and though the dollar was having a largely quiet day there were plenty of jarring moves in emerging markets to raise the pulse rate.

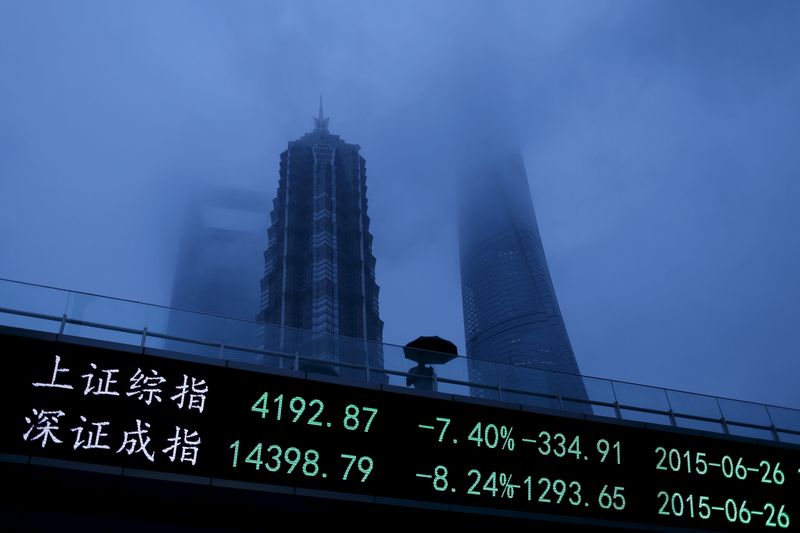

Turkey's lira TRY= slid more than 3 percent along with its main stock market .IS after its central bank opted to keep interest rates on hold despite double-digit inflation that would best be tackled via a big rate hike. offshore yuan meanwhile had hit a one-year low and Beijing's government bond yields had jumped after the cabinet said it would pursue a more vigorous fiscal policy and as traders bet on further easing in monetary conditions. big story is that the Chinese currency continues to slide," said Societe Generale (PA:SOGN) FX strategist Alvin Tan.

"It is clear the government is moving towards policies that are supporting growth," he adding, saying the trend was likely to bring a reaction from the United States in time.

For now though the focus in the U.S. remains the banner corporate earnings season. To date, 82 percent of the 90 S&P 500 companies that have posted results had topped profit estimates, according to Thomson Reuters I/B/E/S.

Analysts estimate of profit growth have risen to about 22 percent for the second quarter, up from 20.7 percent at the start of the month.

E-Mini futures for the S&P 500 .SPX firmed 0.2 percent, as European bourses continued to shuffle higher.

Tech stocks were set to get a boost from Alphabet, the parent of Google GOOGL.O , which was up 4.6 percent in premarket trading a record high, valuing the group at around $900 billion .N

Other FAANG stocks also rose. Facebook FB.O climbed 1.9 percent, while Amazon AMZN.O gained 1.4 percent. Twitter TWTR.N gained 0.9 percent.

European stocks were also up, partly thanks to some upbeat results from UBS, autos firm PSA and chipmaker AMS .EU , higher metals prices MET/L and renewed signs of strength in Germany's powerful manufacturing sector ECONALLEZ .

But they were also just riding in the slipstream of Asia's and Wall Street's overnight gains. .EU

Shanghai blue chips .CSI300 had closed up 1.5 percent at a one-month high .SS and Japan's Nikkei .N225 had added 0.5 percent, even though a disappointing reading on factory activity suggested the threat of a trade war was starting to bite. WILL BUY THESE BONDS?

Bond bulls were still smarting from speculation that the Bank of Japan is close to scaling back its monetary stimulus, a risk that lifted long-term borrowing costs globally. were worried that Japanese investors would have less incentive to hunt offshore for yield, said ANZ economist Felicity Emmett.

"The 10-basis-point steepening in the Japanese yield curve is massive in the context of a market that rarely moves more than 1 basis point," she said. "It reflects a broader fear that central banks are reducing their purchases while U.S. bond supply is set to rise significantly."

As a result, 10-year U.S. Treasury yields hovered around their highest in five weeks at 2.95 percent US10YT=RR , and were again nearing the 3 percent mark.

Germany's government bond yields rose to a five-week high of 0.416 percent. Most other euro zone yields were higher by 1-3 basis points. GVD/EUR

"Global stocks, Asian stocks in particular have seen a boost from (potential) policy-easing measures in China, and this helps the general risk sentiment and adds to some of the headwinds to bond markets," said Commerzbank (DE:CBKG) strategist Rainer Guntermann.

GDP GUESSING GAMES

Part of the shift in yields was caused by talk that data on second-quarter U.S. economic growth, due on Friday, would top current forecasts of 4.1 percent.

Dealers noted some media reports that President Donald Trump was predicting an outcome of 4.8 percent. That would not be out of bounds, given the widely-watched Atlanta Fed GDP tracker puts growth at an annualised 4.5 percent.

Such a strong outcome would only add to the risk of faster rate increases from the Federal Reserve and underpin the dollar.

Against a basket of currencies, the dollar was barely moved at 94.56 .DXY compared with a low of 94.207 on Monday. It bought 111.19 yen JPY= , against Monday's trough of 110.75.

The euro EUR= stalled to $1.1695, having run into profit-taking at a peak of $1.1750 overnight. Turkey's lira was still down 3 percent TRY= after the inaction from its central bank was seen as a missed chance to get some much-needed credibility.

In commodity markets, oil prices were a shade firmer as the focus flicked between oversupply worries and escalating tensions between the U.S. and Iran. O/R

U.S. crude CLc1 added 24 cents to $68.12. Brent LCOc1 edged up 10 cents to $73.17 a barrel.

Spot gold XAU= was barely budged at $1,224 an ounce.

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ China reserve requirement ratios vs Yuan

https://reut.rs/2Lx3LcG

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>