By Dhirendra Tripathi

Investing.com – Globalfoundries stock (NASDAQ:GFS) traded about 1% higher in Monday’s premarket after Advanced Micro Devices (NASDAQ:AMD), its former parent and still a key client, expanded the size of a previous order to buy more silicon wafers from the company and for a longer period.

AMD, whose own share price was up 0.6% in premarket trading, will now buy about $2.1 billion of silicon wafers from GlobalFoundries through 2025 under an amended agreement, according to a regulatory filing Thursday.

The enhanced order comes as shortage of chips refuses to go away – largely owing to shift to a digital ecosystem accelerated by Covid-19. With existing supplies stretched as the pandemic rages and new capacities taking time, it’s a seller’s market that AMD is trying to capitalize on.

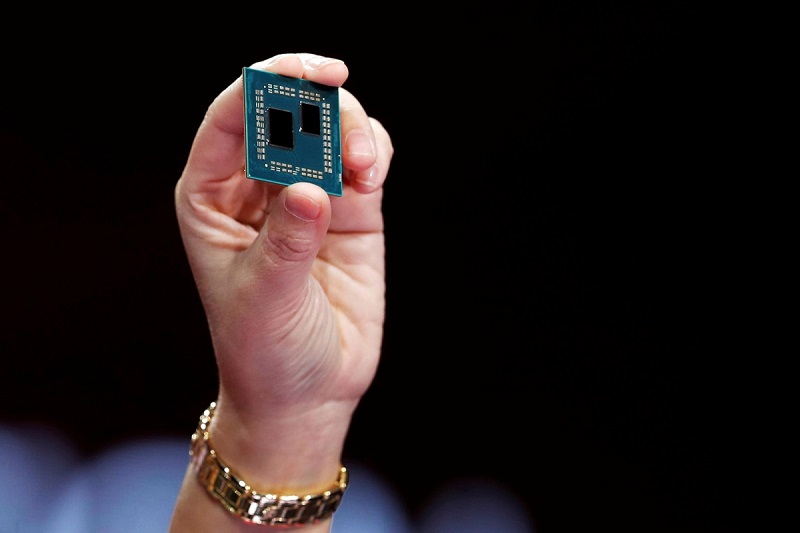

AMD was previously going to buy $1.6 billion worth of wafers between 2022 and 2024, meaning a 30% expeansion. Wafers are the large discs of silicon on which computer chips are made.

GlobalFoundries, which was spun off from AMD in 2009, also counts Qualcomm (NASDAQ:QCOM), NXP (NASDAQ:NXPI) and Broadcom (NASDAQ:AVGO) as major customers. It re-listed on the Nasdaq in October.

Last month, Facebook-owner Meta Platforms (NASDAQ:FB) picked AMD chips to go into its data centers. AMD, having proven itself as a worthy competition to Intel (NASDAQ:INTC), is now taking on larger rivals such as Nvidia (NASDAQ:NVDA) in supercomputing markets.