The global commodities market is witnessing a complex interplay of supply and demand dynamics, with Goldman Sachs (NYSE:GS) maintaining a bearish outlook on lithium, even as iron ore prices receive a boost from Chinese economic stimulus expectations. The investment bank has projected additional potential declines in lithium prices, with spodumene spot prices already having plummeted over 75% to $1,650 per tonne this year. This trend is mirrored in China, where prices for lithium hydroxide and carbonate hover around $19,000-$20,000 per tonne, respectively.

Analysts at Goldman Sachs believe it's too early to expect a market rebound for lithium. They anticipate a surplus of the metal, with projections showing an excess of 29K tonnes LCE (lithium carbonate equivalent) in 2023 that could swell to 202K tonnes LCE by 2024. This upcoming surplus is attributed to increased production that is not being matched by the growth rates in the electric vehicle (EV) sector.

In Australia, non-integrated refineries are facing high costs for lepidolite and spodumene inputs averaging between $19,000-$27,000 per tonne. These costs could lead to significant losses as the industry grapples with a predicted surplus. Core Lithium (OTC:CXOXF) is feeling the financial pressure on its BP33 mine, although its share value has been only mildly impacted due to merger and acquisition speculation.

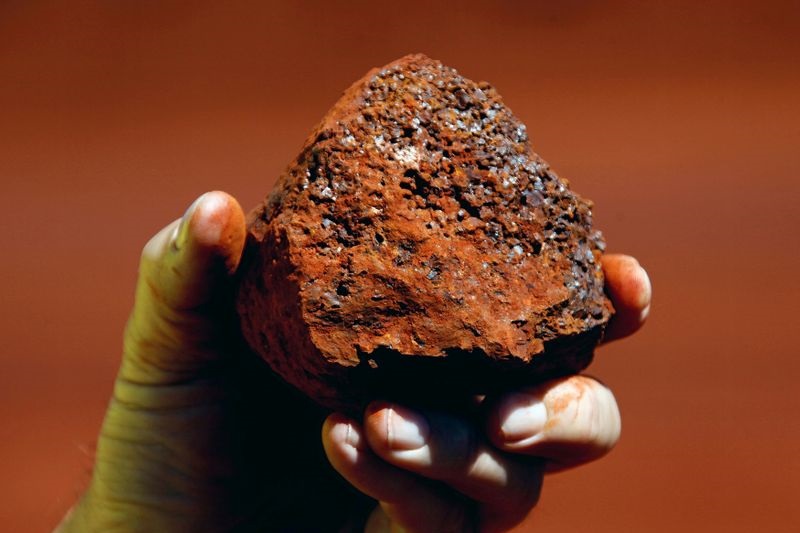

Contrasting this bearish view on lithium, the iron ore market is experiencing near-record stock levels following Fortescue Metals Group (OTC:FSUGY)'s (FMG) annual general meeting (AGM). Iron ore demand has surged, pushing prices to $134 per tonne. This increase is largely driven by prospects of Chinese economic stimuli. The positive sentiment extends to other major miners such as BHP and Rio Tinto (NYSE:RIO).

Gold miners are also seeing their fortunes rise as gold prices crest at $2,000 per ounce. This uptick comes despite potential future pressures from a strengthening U.S. dollar as indicated by recent Federal Open Market Committee (FOMC) minutes.

In the gold sector, De Grey Mining reported gains after expanding resources at its Hemi gold project beyond 10 million ounces. Investors are also anticipating dividends from FMG's profitable iron operations despite scrutiny over executive remuneration and legal concerns involving board members highlighted during their AGM.

Goldman Sachs challenges the common narrative of slow mine ramp-ups by pointing out that new mining projects are achieving capacity more quickly than expected and with improved recovery rates. However, they note that underground mining costs have escalated by around 40%, which could impact future profitability in the sector.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.