By Sethuraman N R and Pratima Desai

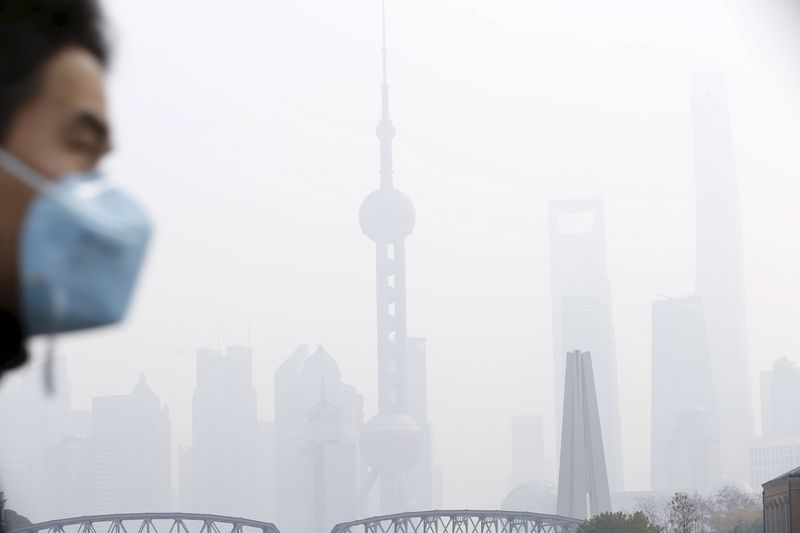

BENGALURU/LONDON, Feb 7 (Reuters) - China's environmental crackdown is curbing supplies of minor metals such as steel-making ingredient vanadium and defence equipment material germanium, and fuelling an already potent price rally which shows no sign of abating.

Strict environmental rules and inspections to ensure standards are being met has meant cutbacks and shutdowns in high-polluting industries such as mining, smelting and recycling, hitting China's output of metal.

China is the world's largest producer and consumer of refined industrial and minor metals.

China's environment ministry recently said it was drawing up details of a new "battle plan" to curb pollution over the 2018-2020 period, after the previous five-year plan helped reduce hazardous pollution. increasingly stringent environmental policy was a big story in 2017 and will remain a key driver for the metals market in 2018," Ming He, senior manager at consultants Wood Mackenzie said.

"Environmental policies should continue to cause more supply disruptions. Environmental campaigns and safety checks will lead to more mine supply curtailments or closures."

Analysts say last year's strong price gains of minor metals produced in China are likely to be repeated this year.

One top performer is vanadium, used to strengthen steel and a vital element in batteries for grid storage.

Prices of ferro-vanadium VAN-FERRO-LON have more than doubled from January 2017 to $59 a kg to nine-year highs.

"China's vanadium mine supply has already been impacted by more stringent environmental monitoring ... We see a situation where China becomes a net importer of ferro-vanadium," BMO Capital Markets analyst Colin Hamilton said in a note.

Top steel producer China, accounting for more than 55 percent of global vanadium output estimated at 76,000 tonnes in 2016, according to United States Geological Survey data. Global demand is estimated at around 80,000 tonnes

Germanium used in optic fibres for military equipment and in wide-angle camera lenses is another metal which stands out. Prices of germanium metal GERM-LON at $1,550 a kg have more than doubled since January last year.

Its gains have in recent weeks been boosted by major germanium refiner Teck Resources TECKb.TO , which declared partial force majeure and reinforced concerns about Chinese supply hit by production cutbacks. force majeure gave another lift to prices already rising because of China cutbacks," a London-based germanium trader said.

Overall, expectations of higher spending on defence, particularly in the United States are expected to sustain germanium prices over coming months.

Also heading the performance table is molybdenum, which because of its anti-corrosion properties is a key ingredient in industrial applications of stainless steel, production of which is dominated by Chinese mills.

Molybdenum supplies too have been hit by new environmental rules in China, which produced nearly 40 percent of global output estimated at 227,000 tonnes.

Ferro molybdenum MLY-FERRO-LON at around $30 a kg has rallied more than 60 percent over the last year.

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ Top minor metal performers

http://reut.rs/2BJjSTu China steel output vs ferro vanadium

http://reut.rs/2Bf35GU US defense spending vs germanium

http://reut.rs/2BHzvKT China industrial production vs ferro molybdenum

http://reut.rs/2BasCkp

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> (Editing by David Evans)