Kalkine Media -

Highlights

- Alimentation Couche-Tard achieved net earnings of US$ 810.4 million in Q2’23.

- Maple Leaf’s primary meat protein group sold 3.8 per cent higher goods in Q3’22 YoY.

- Dollarama Inc. grew its sales from C$ 1,222.3 million in Q3’22 to C$ 1,289.6 million in Q3’23.

There are two divisions within the Canadian consumer stocks market. The first is the consumer staples sector, which contains items used every day, and the second is the consumer discretionary sector, which includes restaurants, accommodations, and clothing, or consumer durables, items that last for a long time, like furniture, home décor, and electronic items.

Consumer stocks tend to provide consistent profits even in weak economies since they sell products like food and other everyday essentials. But this doesn’t imply that they are immune to the stock market turbulence, so investors should do their homework before adding consumer stocks to their portfolios.

Having said that, let’s see how these three TSX-listed consumer stocks have been performing lately:

Alimentation Couche-Tard (TSX: ATD) Operating a network of convenience stores across North America, Russia, Ireland, Poland, Scandinavia, and the Baltics, Alimentation Couche-Tard is a consumer staples company. Couche-Tard provides products and services, like tobacco, fresh food, groceries, road transportation fuel, car wash, stationary energy, etc.

With a market capitalization of over C$ 59 billion, Alimentation Couche-Tard returned C$ 0.14 per share to its shareholders in the form of cash dividends on a quarterly term.

For the second quarter of 2023, Couche-Tard mentioned growing net earnings to US$ 810.4 million from US$ 694.8 million in the same period last year. On the other hand, adjusted net earnings also improved from US$ 693 million in Q2’22 to US$ 838 million in Q2’23.

While the company’s total merchandise and service revenues increased by 2.3 per cent in Q2’23 to the prior comparable period, merchandise and service gross margin also increased by 0.2 per cent.

In the US, merchandise and service revenues were 5.6 per cent higher, and gross margin was 34 per cent higher in the second quarter of 2023 than in Q2’22.

Maple Leaf Foods Inc. (TSX: MFI) Maple Leaf Foods Inc. is a consumer-packaged meats company that primarily sells in the US, Canada, China, and Japan. In addition to creating prepared meats and meals, Maple Leaf also conducts several agribusiness activities.

The company has a total market share of approximately C$ 3.2 billion and has paid its shareholders a quarterly dividend of C$ 0.20 per share.

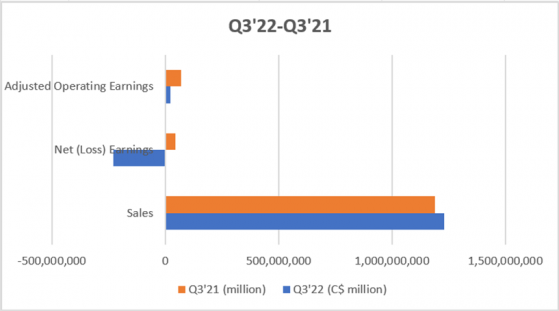

According to Maple Leaf Foods’ third quarter 2022 results, the company improved its sales by 3.6 per cent from the previous corresponding period to C$ 1,231.9 alongside an adjusted EBITDA margin of 6.2 per cent. Maple Leaf’s meat protein group made the biggest contribution; sales were 3.8 per cent higher to C$ 1,194.5 million in Q3’22 year-over-year (YoY).

The company’s financials are summarized below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Dollarama Inc. (TSX: DOL) A Canadian corporation called Dollarama Inc. runs discount retail stores in Canada's major cities and smaller and more suburban towns. The company provides its clients with general merchandise, seasonal goods, and everyday consumer goods.

With a 3-year dividend growth rate of 12.51 per cent, Dollarama has paid its shareholders a cash dividend of C$ 0.055 per share on a quarterly term.

Dollarama mentioned generating 14.9 per cent higher sales in the third quarter of 2023, up from C$ 1,122.3 million in Q3’22 to C$ 1,289.6 million. The company’s EBITDA improved in Q3’23, up from C$ 347 million in Q3’22 to C$ 386.2 million.

Bottom Line Although consumer stocks might look attractive, investors should always conduct thorough market research before investing because the stock market is still circling from extreme volatility triggered in the second half of 2022.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.