GuruFocus - On August 13, 2024, Paul Keel, Chief Executive Officer of Envista Holdings Corp (NYSE:NVST), purchased 30,000 shares of the company, as reported in a recent SEC Filing. Following this transaction, the insider now owns a total of 402,605 shares of Envista Holdings Corp.

Envista Holdings Corp operates in the healthcare sector, focusing on dental products and technologies. The company's portfolio includes a range of products for dental professionals, including diagnostic, restorative, and preventive products.

The transaction occurred with shares priced at $16.87, valuing the purchase at approximately $506,100. This acquisition has increased the insider's stake significantly, reflecting a strong commitment to the company's future.

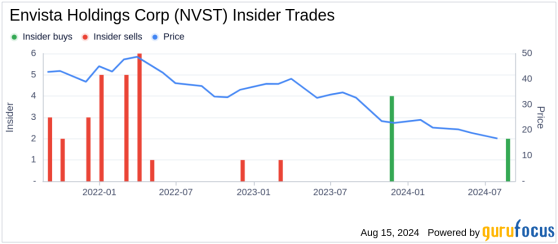

Over the past year, Paul Keel has engaged in multiple transactions, purchasing a total of 30,000 shares and selling none. This pattern of insider buying might signal confidence in the company's strategic direction and future growth prospects.

Envista Holdings Corp's stock currently holds a market cap of approximately $2.98 billion. The company's valuation metrics, such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, are calculated based on historical trading multiples, adjustments for past performance, and future business expectations.

According to the GF Value, the intrinsic value of Envista Holdings Corp's stock is estimated at $35.85, suggesting that the stock is currently undervalued with a price-to-GF-Value ratio of 0.47. This valuation indicates that the stock might be a Possible Value Trap, and potential investors should think twice before making an investment decision.

The insider transaction history for Envista Holdings Corp shows a trend of more insider buying than selling over the past year, with 6 insider buys and 0 insider sells. This could be interpreted as a positive signal by market observers and potential investors looking at the insider confidence in the stock's future performance.

This recent purchase by CEO Paul Keel aligns with the overall positive insider buying trend at Envista Holdings Corp, potentially indicating a bullish outlook from those closest to the company's operations.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com