GuruFocus - On September 11, 2024, Maged Shenouda, the Chief Financial Officer of Relmada Therapeutics Inc (NASDAQ:RLMD), purchased 53,432 shares of the company, as reported in a recent SEC Filing. Following this transaction, the insider now owns a total of 88,335 shares of Relmada Therapeutics Inc.

Relmada Therapeutics Inc is a clinical-stage biotechnology firm focused on developing novel therapies for the treatment of central nervous system (CNS) diseases. The company's strategic initiatives aim to address significant treatment gaps for patients suffering from a range of CNS disorders.

The transaction occurred with shares priced at $2.8, valuing the purchase at approximately $149,609.6. This acquisition has increased the insider's stake significantly, reflecting a strong commitment to the company's future. Over the past year, Maged Shenouda has purchased a total of 86,107 shares and has not sold any shares.

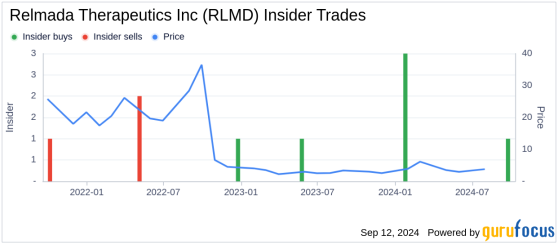

The insider transaction history at Relmada Therapeutics Inc shows a pattern of insider confidence, with 7 insider buys and no insider sells over the past year. This trend suggests a positive outlook among the company's insiders about its future prospects.

Currently, the stock has a market cap of $91.126 million. Investors and analysts monitor insider buying as it can provide insights into how executives view the company's valuation and future performance.

For more detailed valuation metrics such as GF Value, price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, investors can explore further on GuruFocus.

This insider purchase could be a key indicator for investors when considering their own stakes in Relmada Therapeutics Inc, as insider transactions can often precede future developments or financial performance of the company.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com