GuruFocus - On August 2, 2024, Joli Gross, Senior Vice President, Chief Legal & Sustainability Officer of United Rentals Inc (NYSE:URI), sold 360 shares of the company. The transaction was executed at a price of $690 per share, as detailed in the SEC Filing. Following this sale, the insider now owns 4,090 shares of United Rentals Inc.

United Rentals Inc is a leader in the equipment rental industry, providing a wide range of equipment rental services across various sectors. The company's offerings include construction and industrial equipment rentals, which cater to a diverse clientele seeking reliable and efficient solutions for their operational needs.

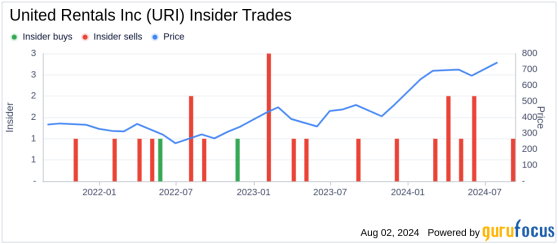

Over the past year, Joli Gross has sold a total of 800 shares and has not made any purchases of the company's stock. This recent transaction is part of a broader trend observed within the company, where there have been 9 insider sells and no insider buys over the past year.

The shares of United Rentals Inc were trading at $690 on the day of the sale, giving the company a market cap of approximately $44.41 billion. The price-earnings ratio of the company stands at 17.74, which is slightly lower than the industry median of 18.195 but higher than the company's historical median.

According to the GF Value, the intrinsic value of United Rentals Inc is estimated at $546.03 per share, making the stock modestly overvalued with a price-to-GF-Value ratio of 1.26.

The GF Value is calculated based on historical trading multiples like the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, adjusted by a GuruFocus factor which considers past returns and growth, and supplemented by future business performance estimates from Morningstar analysts.

This insider sale might interest investors tracking insider behaviors as an indicator of the company's future performance and valuation perspectives. The transaction details and the company's valuation metrics provide a snapshot of United Rentals Inc's current financial position and market perception.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com