GuruFocus - Senior Vice President and Chief Financial Officer Dominic Savarino sold 11,369 shares of Diamond Offshore Drilling Inc (OTC:DOFSQ) (NYSE:DO) on June 3, 2024, according to a recent SEC Filing. Following this transaction, the insider now owns 40,852 shares of the company.

Diamond Offshore Drilling Inc (NYSE:DO) is a leader in offshore drilling, providing contract drilling services to the energy industry around the globe with a total fleet of offshore drilling rigs. The company's fleet consists of semisubmersibles, dynamically positioned drillships, and deepwater drilling rigs.

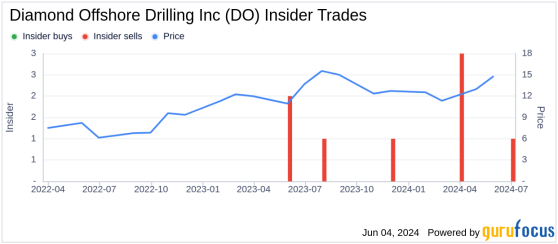

Over the past year, the insider has sold a total of 40,378 shares and has not made any purchases. The recent transaction forms part of a broader trend observed over the past year, where there have been eight insider sells and no insider buys at Diamond Offshore Drilling Inc (NYSE:DO).

Shares of Diamond Offshore Drilling Inc (NYSE:DO) were trading at $15.11 on the day of the transaction. The company has a market cap of approximately $1.376 billion.

For more detailed valuation metrics, the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow can provide further insights into the stock's current market valuation. Additionally, the GF Value offers a unique calculation of the fair value that investors may consider for assessing potential investment opportunities.

This insider sale might be of interest to investors tracking insider behaviors and company stock trends, providing a glimpse into the financial movements within Diamond Offshore Drilling Inc (NYSE:DO).

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com