Highlights:

- In Q2 2022, there was an increase in Andlauer Healthcare Group Inc.’s net income and EBITDA.

- As of June 1, 2022, SIA completed a C$ 72 million Joint Venture Acquisition.

- As of October 4, 2022, the stock price for DR is US$ 10.59.

The healthcare stocks are pretty diverse, and healthcare facilities and pharma companies are large businesses. During the pandemic, healthcare stocks soared for obvious reasons.

If you are looking for investment, look at the factors that affect these stocks and the overall market. Keep your portfolio healthy by diversifying it. There are several fluctuations daily that need to be tracked and checked regularly.

Here, we look at five healthcare stocks and their performances in recent quarters:

In Q2 2022, Andlauer Healthcare registered an increase in revenue by 58.1 per cent and was reported at CC$ 169.4 million compared to C$ 107.1 million in Q2 2021.

The operating income increased by 60.5 per cent and was reported at C$ 30.2 million compared to C$ 18.8 million in the same quarter the previous year.

The growth in net income was by 60.8 per cent (C$ 21 million), while EBITDA rose to C$ 46.3 million vs C$ 30.0 million in Q2 2021.

The company’s earnings per share (EPS) was C$ 2.55.

Presently, the total market capitalization of WELL Health is C$ 689.275 million.

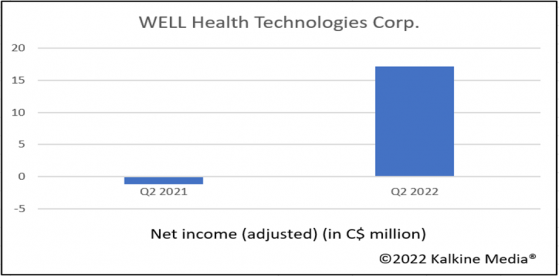

In Q2 2022, WELL Health Technologies Corp. had a 127 per cent year-over-year (YoY) increase in its revenue which was calculated at C$ 140.3 million.

There was an increase in EBITDA, too which was C$ 26.4 million compared to C$ 11.9 million in Q2 2021.

Reportedly, as of May 18, 2022, the company began trading on OTCQX Market to broaden its American investor base.

The below graph illustrates the company’s net income (adjusted) from Q2 2021- Q2 2022.

The total revenue (adjusted) of Sienna Senior Living in Q2 2022 increased by 10.7 per cent to C$ 180.2 million. Reportedly, the increase was driven by an annual rental rate increase, occupancy growth, and additional revenues.

The company reported increasing debt to adjusted EBITDA from 7.4 years to 9.5 years, compared to Q2 2021. Further, as of June 30, 2022, the company's liquidity grew to C$ 270.7 million, with an increase of C$ 45.1 million from December 31, 2021.

As of June 1, 2022, Sienna Senior Living Inc. acquired The Village at Stonebridge worth C$ 72 million. It was a Joint Venture Acquisition. The net operating income in the reported quarter increased by 10.3 per cent to C$ 34.2 million.

Bausch Health Companies Inc.’s revenue for the second quarter of fiscal 2022 was reported at C$ 1.967 billion compared to C$ 2.1 billion in the corresponding quarter in 2021. For the quarter that ended June 30, 2022, the net income of the company decreased and was reported at C$ 211 million as compared to C$ 354 million in the same quarter the previous year.

As of June 30, 2022, the EBITDA was reported at C$ 625 million, relative to C$ 96 million in the year-ago quarter.

As of October 4, 2022, the stock price for Medical Facilities Corporation was US$ 10.59 and increased by 8.17 per cent within 12 months.

Compared to Q2 2021, Medical Facilities Corporation’s total revenue and other incomes in Q2 2022 increased by 4.5 per cent to US$ 102.5 million.

EBITDA decreased by 9.1 per cent to US$ 21.5 million in the same comparative period.

Reportedly, the company's surgical case volumes and facility service revenue also increased by 5.6 per cent and 4.7 per cent respectively.

Bottom Line: Investment requires grabbing the right opportunity at the right time. The portfolio growth is based on the stocks that you choose. Picking up stocks requires alertness and awareness about the overall market.

Look into different asset pools and analyze their yield. Finally, one should choose the stocks that match the portfolio and goals.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.