HighlightsThe financial sector accounts for 30.78 per cent of the total TSX composite index. Many factors govern the financial operating environment, including the interest rate, fear of default, and several other uncertainties.

The post-pandemic effect can be seen in every stock. Technology has also accelerated and brought about changes in existing projects.

Many companies are now relying on changing technology for their stock’s fate. From a long-term perspective, consider all the factors that impact financial stocks.

Let’s have a look at the performances of five TSX financial stocks in recent quarters:

The company operates through its brand Intact Insurance and BrokerLink (wholly owned subsidiary) and distributes insurance under it through a network of brokers. Further, the company does direct distribution to consumers through Belairdirect.

In Q2 2022, Intact Financial’s net income of C$ 1,184 million noted an increase of 107 per cent compared to C$ 573 million in Q2 2021.

Currently, the quarterly dividend announced by the company is C$ 1. The five-year dividend growth was reported at 7.57 per cent.

The stock price increased by 21.43 per cent within 12 months and was C$ 198.83 as on October 6, 2022.

For Q3 2022, the National Bank of Canada posted a net income of C$ 826 million and a decrease of 2 per cent from the previous year at C$ 839 million.

The company’s diluted earnings per share were C$ 2.35 compared to C$ 2.36 in the same quarter a year ago.

The basic earnings per share (EPS) announced by the company is C$ 2.38 in comparison to C$ 2.39 same quarter previous year.

On July 31, 2022, the total assets were reported at C$ 387,051 million.

The quarterly dividend announced by the National Bank of Canada to its shareholders was C$ 0.92, with a dividend yield of 4.196 per cent.

The net income of the Royal Bank of Canada in Q3 2022 was C$ 3.6 billion, with a year-on-year (YoY) decrease of 17 per cent. The diluted EPS, too, decreased by 15 per cent YoY at C$ 2.51.

Relative to last quarter, the company’s net income decreased by C$ 316 million or 40%, triggered by lower fixed-income trading revenue.

Reportedly, on September 27, 2022, the Royal Bank of Canada announced the completion of its acquisition of Brewin Dolphin Holdings PLC (wealth management firm).

In Q2 2022, the net income of Manulife Financial Corporation was C$ 1.1 billion. Further, the core earnings were reported at C$ 1.6 billion, which went down by 9 per cent on a constant exchange rate basis for the same comparative period.

On June 30, 2022, the Total Invested Assets were reported at C$ 402,329 million compared to C$ 409,401 million on March 31, 2022.

In Q2 2022, Trisura Group registered a net income of C$ 20.2 million compared to C$ 16.9 million in Q2 2021.

As on June 30, 2022, the cash and cash equivalents were C$ 367.96 million as compared to C$ 341.31 million as on December 31, 2021.

The total assets were reported at C$ 3.48 billion in Q2 2022. The total liabilities of the company in Q2 2022 were 3.132 billion.

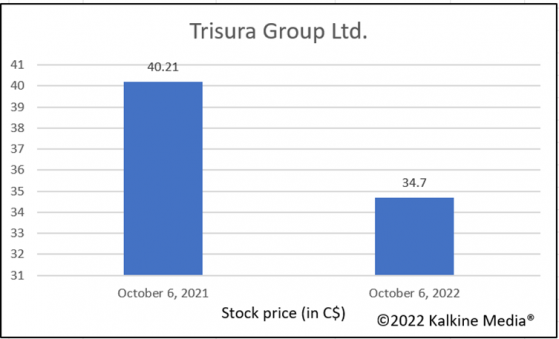

In Q2 2022, the total revenue increased to C$ 125.50 million from C$ 86.72 million in Q2 2021. The below graph picturizes the difference between the stock price of Trisura Group Ltd. within 12 months.

Bottom Line The financial sector is mammoth, and fluctuations keep happening daily. Before investing your money, study all the factors and strategize your investments accordingly. A thorough background check of a stock’s fundamentals is advisable before investing.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.