By Ketki Saxena

Investing.com -- Earlier today, Nuvei (TSX:NVEI) released Q2 2023 earnings that missed analyst expectations, and downwardly revised its full year guidance, causing shares to tank.

Nuvei reported a net income of $11.6 million compared to net income of $35.1 million this time last year.

Revenue totalled $307M, in line with analyst expectations, and up from $211.3M (NYSE:MMM) in Q2 of last year.

While earnings were a miss, it's Nuvei's downward revision of forward third quarter and full-year guidance for revenue, total volume and adjusted EBITDA that spooked investors, and sparked a sell-off in Nuvei shares.

Nuvei's Q3 Forecast

For the third quarter, Nuvei now targets revenue at $300M-$308M, below the $318.8M analyst consensus.

Adjusted EBITDA for Q3 is anticipated at $105M-$110M, vs. the analyst consensus of $119.6B.

Q3 total volume is expected to come in at $47.5B-$49.5B, in line with the $48.3B analyst consensus.

Nuvei's Full Year 2023 Forecast

The company now sees total revenue of $1,170M-$1,195M, trailing the $1.24B average analyst estimate, down from the prior target range of $1,225M-$1,264M.

Total volume for 2023 is expected to be $193B-$197B, vs. $200.7B analyst consennsus, and compared with the $196B-$202B previous target.

Adjusted EBITDA is expected at $417M-$432M, vs. $465.3M analyst estimates, down from $456M-$477M in the previous target.

Is Nuvei a Buy?

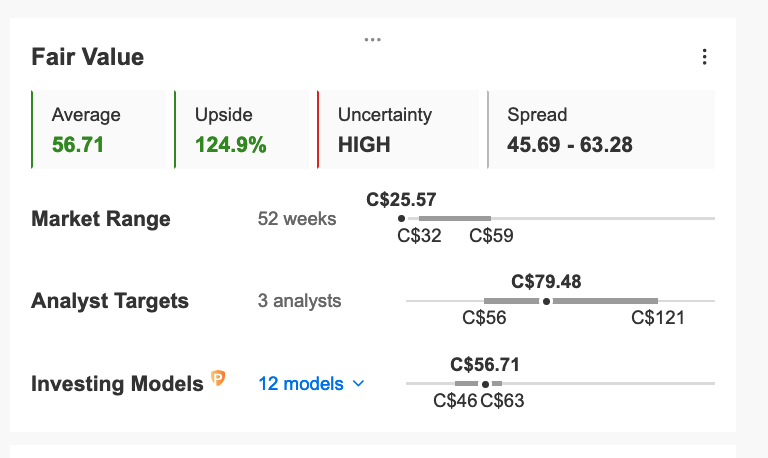

At time of writing, Nuvei shares were changing hands at $25.21. Investing Pro models suggest a fair price target of 56.71, representing a financial upside potential of 124.9%.

Analysts are even more bullish on the stock, with a target price of $79.48. All 12 analysts covering Nuvei currently have a buy rating on the stock.

Source: Investing Pro

Nuvei Stock Cons to Consider:

- Trading at a high earnings multiple

- Revenue growth has been slowing down recently

- Stock price movements are quite volatile

- Price has fallen significantly over the last three months