Investing.com -- Rheinmetall AG (ETR:RHMG) is on track for another year of strong growth, confirming its annual guidance for 2024. The company projects sales around €10 billion, supported by a strong order book and significant market demand.

With an expected operating margin improvement to 14%-15%, Rheinmetall's strategic investments and expansions are clearly paying off.

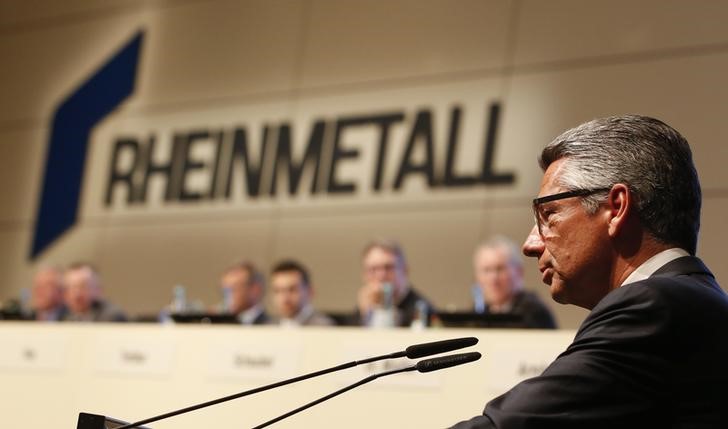

“We massively expanded capacities, made acquisitions and are now also additionally building new plants in countries like Lithuania, Hungary, Romania and Ukraine.,” said Armin Papperger, chief executive at Rheinmetall AG.

Rheinmetall reported strong results in the first half of 2024, driven by high demand in both military and civilian sectors. Sales surged by 33% year-over-year, amounting to €3.8 billion, a significant jump from the previous year's €2.861 billion.

This growth was propelled by increased demand from the armed forces of Germany, EU and NATO partners, as well as substantial support for Ukraine.

The operating result showcased a remarkable 91% increase, rising from €212 million to €404 million. This was attributed to higher sales and the profit contribution from Rheinmetall Expal Munitions, acquired in 2023.

The operating margin saw an increase to 10.6% from the previous year's 7.4%.

Rheinmetall's order intake and future commitments, referred to as Rheinmetall Nomination, soared to over €15 billion, more than double the previous year's figure.

This surge was largely driven by substantial orders from Germany, including a special fund for the Bundeswehr and support for Ukraine.

Consequently, the backlog reached a new high of €48.6 billion, a 62% increase from the previous year's €30 billion.

The vehicle systems segment reported a 28% sales jump, to €1.3 billion. Despite a slight increase in Rheinmetall Nomination to €3.114 billion and a 31% growth in backlog to €18.148 billion, the operating margin decreased slightly to 9.2%, with an improved operating result of €119 million.

In the weapon and ammunition segment, sales surged by 93% to €1.054 billion, driven by a rise in Rheinmetall Nomination to €8.828 billion. The backlog more than tripled to €19 billion, with the operating result more than doubling to €206 million and the margin improving to 19.5%.

The electronic solutions segment saw a 28% increase in sales to €647 million. Rheinmetall Nomination quadrupled to €3.020 billion, and the backlog increased to €6.609 million, up from €3.685 million. The operating result improved to €53 million, with the margin rising to 8.3%.

The power systems segment experienced a slight sales increase to €1.056 billion, although Rheinmetall Nomination decreased to €7.938 billion and the backlog dropped by 9.9% to €7.938 billion. However, the operating result increased to €57 million, with the margin improving to 5.4%.