Kalkine Media -

Highlights

- Canada stands as the world’s fifth largest gold producer as of 2020, says Statistics of Canada.

- On a YTD basis, Agnico Eagle has generated a net income of US$ 465.2 million.

- For the nine months ended September 2022, Franco-Nevada had no debt, with US$ 2 billion cash in hand.

When it comes to commodities, gold tops the charts as Canada’s most valuable commodity, with a production value of C$ 12.3 billion as of 2020. According to Statistics of Canada, over 182 tonnes of gold was extracted in the year 2020 from Canadian mines, placing Canada as the world’s fifth largest gold producer.

Having said that, let’s see how these three TSX-listed gold stocks have been performing lately:

Barrick Gold (NYSE:GOLD) Corporation (TSX: ABX) Barrick Gold Corporation poses itself as a leading gold producer, with operating facilities in North and South America, Australia, and Africa. The company has a total market share of more than C$ 43.2 billion, generating a big chuck of revenues from one of its nine gold mines, Carlin, in Nevada, USA.

Barrick announced to the market of producing 4.14 million ounces of gold for the preliminary period of 2022 alongside Q4 output to be 13 per cent higher than Q3 production. Meanwhile, the company’s copper production of 440 million pounds remained in line with the previously stated guidance range of 420-470 million pounds.

According to early Q4 sales results, 1.11 million ounces of gold were sold, with 1.12 million ounces of gold in production, at an average market price of US$ 1,726 per ounce. Following this, Barrick anticipates that its Q4 gold cost of sales per ounce will be 4-6 per cent higher than the previous quarter (Q3'22).

Barrick is set to release its Q4’22 and full year 2022 results on February 15, 2023.

Agnico Eagle Mines Limited (TSX: TSX:AEM) Canada’s one of the oldest gold mining companies, Agnico Eagle Mines Limited, operates in Canada, the US, Mexico, Australia, Finland, and Colombia. Since 1983, Agnico Eagle has paid annual cash dividends to its shareholders, the most recent being US$ 0.40 per common share on a quarterly basis.

The company currently has a market capitalization of US$ 23.91 billion.

With Agnico Eagle set to declare its fourth quarter and full year 2022 results on February 16, 2023, let’s flick through its performance in the last quarter. In Q3’22, Agnico Eagle generated net income and cash from operating activities of US$ 79.6 million and US$ 575.4 million (up from US$ 297.2 million in Q3’21), respectively.

Apart from this, in the first nine months of 2022, the company reported a net income of US$ 465.2 million, up from US$ 460.6 million in Q3’21.

Franco-Nevada Corporation (TSX: FNV) Franco-Nevada Corporation, a royalty and investment firm focused on precious metals, has its main operations in the US, Canada, and Australia. While the company’s portfolio of assets is varied by commodity, revenue source, and project stage, a significant portion of its revenue comes from gold, silver, and platinum.

With a market cap of C$ 36.5 billion, Franco-Nevada has paid a quarterly cash dividend of US$ 0.34 per share to its shareholders alongside 3-year and 5-year dividend growth rates of 9.16 per cent and 4.98 per cent, respectively.

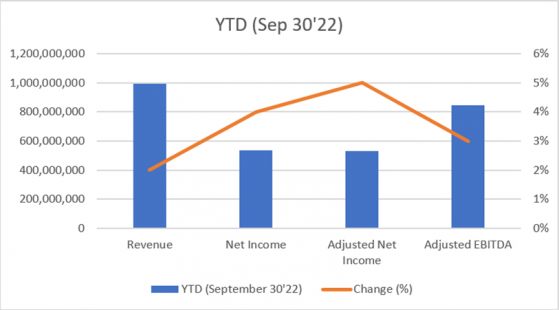

For the first nine months of 2022, the company mentioned achieving record GEOs, revenue, adjusted EBITDA, net income, and adjusted net income. Additionally, Franco-Nevada produced an operating cash flow of US$ 232.3 million for the third quarter of 2022.

As of September 30, 2022, the company had US$ 2 billion in cash in hand and no debt.

Franco-Nevada’s financials can be seen below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Bottom Line Before putting bets in the stock market, investors are advised to do extensive research because volatility has continued since the second half of 2022, and anything can happen at any time.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.