Did you know that the big Canadian banks are great investments that offer stable dividend income and returns? That’s why they make great core holdings for any long-term diversified portfolio.

Table 1 below shows the performance and dividend-generating power of the Big Six banks from before the last recession more than a decade ago. National Bank delivered the best total returns and dividend returns, but Toronto-Dominion Bank (TSX:TD)(NYSE:TD) had the highest dividend growth.

| Bank | 1 Annualized total returns | 2 Dividends received | 3 Dividend growth rate | 4 Starting yield | 5 Yield on cost |

| National Bank | 10.2% | $7,285 | 7.9% | 3.7% | 8% |

| Royal Bank of Canada | 7.8% | $5,434 | 8.4% | 3.7% | 7.6% |

| TD Bank | 9% | $5,541 | 9.4% | 3.2% | 8% |

| Bank of Nova Scotia | 5.9% | $5,229 | 6.7% | 3.5% | 6.7% |

| Bank of Montreal | 6.8% | $5,584 | 4.4% | 3.9% | 5.4% |

| Canadian Imperial Bank of Commerce | 4% | $4,545 | 5.6% | 3.6% | 6.1% |

1 Annualized total returns since fiscal 2008 (right before the last recession)

2 Dividends received from a $10,000 initial investment since fiscal 2007

3 The compound annual growth rate of the dividend per share from fiscal 2007-2018

4 Starting yield in fiscal 2007

5 Yield on cost by fiscal 2018 based on a $10,000 initial investment in fiscal 2007

How to outperform with a stable dividend growth stock

Table 2 below offers insight as to why National Bank, a stable dividend growth stock, outperformed in the last decade. First, it traded at the cheapest price-to-earnings ratio (P/E) at the start of the period. Second, its earnings-per-share growth in the period was above average. Third, it ended the period at a higher P/E than when it started.

The lower the P/E you pay for the same earnings growth (given all else equal), the cheaper you paid for a stock, and the higher your returns should be.

Earnings growth leads to dividend growth

Earnings-per-share growth should lead to higher stock prices, and in the case of Canadian bank stocks, dividend growth as well. Essentially, investors can assume higher dividend growth from higher earnings growth.

Indeed, TD Bank had the highest earnings growth of 7.6% per year led to the highest dividend growth of 9.4% in the period.

| Bank | 1 Starting P/E | 2 Earnings growth | Current P/E | 3 Estimated earnings growth |

| National Bank | 9.7 | 7% | 10.2 | 3.2-13.5% |

| Royal Bank of Canada | 13.3 | 6.5% | 11.8 | 5.3-7.3% |

| TD Bank | 12.4 | 7.6% | 11.4 | 6-10.8% |

| Bank of Nova Scotia | 13.3 | 5.3% | 10.4 | 5.5-7.7% |

| Bank of Montreal | 11.1 | 4.3% | 10.7 | 3.9-7.5% |

| Canadian Imperial Bank of Commerce | 12 | 3.3% | 9.2 | 1.6-4.8% |

1 P/E in fiscal 2008

2 Adjusted earnings per share growth rate from fiscal 2007-2018

3 Estimated earnings per share growth rate for the next three to five years

Why TD Bank will outperform in the next decade

As displayed in Table 2, TD Bank has the most positive earnings growth expectation for the next three to five years, with the greatest lowest estimate and the highest mid-point estimate. So, it’s expected to be more predictable and stable than, for example, National Bank, which has s a wide range in its earnings growth estimation. Moreover, TD stock isn’t expensive.

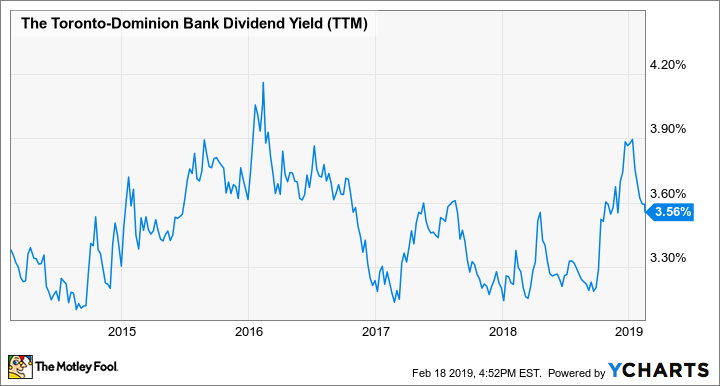

TD’s long-term normal P/E is about 12, which indicates a 12-month target price of roughly $84 per share — more than 11% upside from roughly $75 as of writing. In addition, the stock offers an absolutely safe yield of 3.56% and will be increasing its quarterly dividend either later this month or in early March, likely by 7-11%. If so, that’d be a forward yield of at least 3.8%. Historically, that has been a relatively high yield to pick up shares of the quality bank.

TD Dividend Yield (TTM) data by YCharts. The five-year yield history of TD Bank.

TD Bank’s predictable results are attributable to the proven business model that it has developed and evolved over time. The model focuses on retail banking in North America, delivers consistent earnings growth, and manages calculated risks intelligently. In fact, according to Global Finance, TD is the safest bank in North America.

Investor takeaway

I believe TD Bank is the best big Canadian bank to own for the next decade and beyond. It’s currently reasonably valued and will be increasing its dividend very soon. With a forward yield of about 3.8%, it’s a great time to pick up some shares. Moreover, the stock will be a strong buy whenever it experiences meaningful dips.

Fool contributor Kay Ng owns shares of The Bank of Nova Scotia and The Toronto-Dominion Bank.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2019