(Bloomberg) -- Hopes of luring back global investors to a battered stock market are dimming by the day for Malaysia’s government.

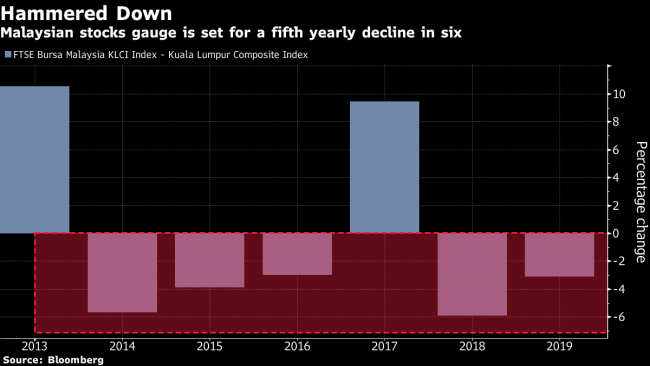

The benchmark FTSE Bursa Malaysia KLCI Index is down 14 percent from a record in May 2018 and it’s the worst major market in the world so far this year, having slipped 3.4 percent. That’s even amid a rally in global equities spurred by the Federal Reserve’s dovish pivot and a potential trade deal between the U.S. and China. The gloomy outlook for Malaysian stocks isn’t likely to end anytime soon, says Samsung (KS:005930) Asset Management Co.

"Malaysia will likely disappoint over the next year because since the new government came in power in May 2018, it has been lowering public debt with fiscal tightening," said Alan Richardson, a regional fund manager at Samsung Asset in Hong Kong. "This will be the theme from May 2018 to May 2020."

Euphoria about Malaysian stocks has faded after almost one year since Mahathir Mohamad’s surprise election victory in May, as the new administration struggled to clean up government inefficiencies and corruption. Unfulfilled campaign promises partly due to the legacy it inherited have also hurt its popularity. The new administration last month lowered its 2019 economic growth forecast and has been on an austerity drive to rein in its budget deficit.

‘Oil Fallacy’

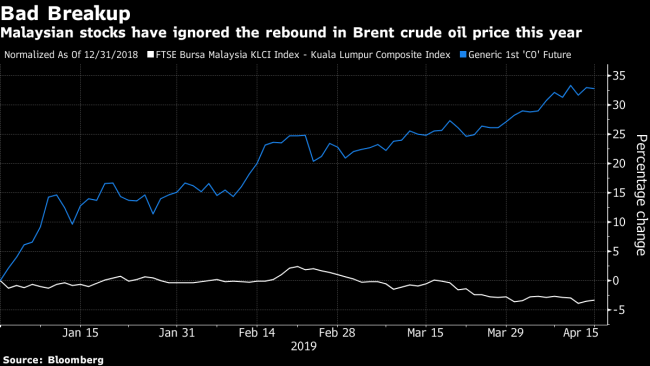

The stocks gauge fell to its lowest since 2016 last week even as the price of crude oil, one of its major exports, has risen by a third in 2019.

"The perception that Malaysia is the only beneficiary in Asia from rising oil prices is a fallacy," Richardson said. "Rising oil price is negative for Malaysia" because it imports more oil products than what it exports as crude, he said.

Foreign investors have dumped Malaysian shares worth more than a net $500 million so far in 2019, according to Bloomberg-compiled data. Malaysia’s central bank in March pledged to keep monetary policy accommodative as global risks weigh on the trade-reliant economy.

Not everyone is bearish. Bharat Joshi, a Jakarta-based fund manager at Aberdeen Standard Investments, is “neutral” on Malaysia stocks and sees green shoots in infrastructure and oil-related stocks. Construction shares and oil and gas stocks will outperform the market following the resumption of talks on projects including the East Coast Rail Link and a rebound in commodity prices, he said.

However, Joshi and Richardson shared a view that the weak performance of the new government and companies have weighed on sentiment so far.

Richardson said he is bearish on Malaysia stocks not because there is a downside risk, but "just that there is nothing to be positive about over the next 12 months."