Horizons Marijuana Life Sciences Index ETF (TSX:HMMJ) closed the day in the blue on Wednesday, up nearly 1% during a trading day in which the S&P/TSX Composite Index declined a whopping 2.12%, as potential interest rate hikes and economic growth concerns weighed in on stock market valuations.

The biggest index gain on the day was the 15.94% rally on the S&P/TSX 60 VIX, an index that estimates the 30-day volatility of the Canadian stock market as implied by the S&P/TSX 60 index; the index is considered a tool to hedge the downturns in the broader equity market.

However, since the volatility index has a negative correlation with the stock market, the hedging tool may not offer any growth during good market days, yet some investors may wish to invest in something that grows with the broader market, and still continues to grow or be resilient during down turns.

Following the desire for a “growing hedge,” one would therefore think, if an index ETF can out-grow a rising market, and still show resilience during bad days, then it’s a beautiful financial asset.

Could this be true with this marijuana ETF?

Marijuana sector resilience?

The HMMJ seeks to efficiently replicate the performance of the 62-stock North American Marijuana Index, which is designed to offer exposure to the performance of a basket of North American publicly listed life sciences companies with significant business activities in the marijuana industry.

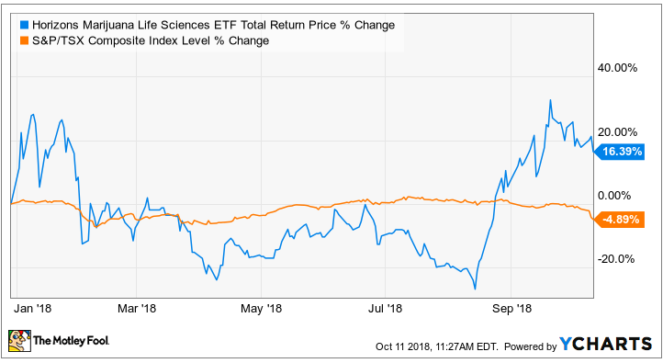

I am not convinced that the marijuana ETF investment can act as a hedge against market downturns today, as this sector has been far too volatile than the TSX and has underperformed the broader market for most of the time during the first three quarters of this year, as shown below.

Horizons Marijuana Life Sciences Index ETF vs S&P/TSX Composite. YTD Performance.

The index’s resilience on Wednesday could have been heavily influenced by the unconfirmed market rumour that low-cost marijuana producer Aphria (TSX:APH) could be in talks with big tobacco giant Altria Group (NYSE:MO). Aphria stock rallied to close 15.16% after the news piece claimed that the maker of Marlboro cigarettes intends to buy a minority interest in Aphria with an intention to end up holding a control stake in the growing cannabis firm.

The news about a potential interest in the cannabis sector by big tobacco firms gives a big lift to the budding industry, as these “big boys” have robust distribution channels and they have mastered the art of surviving even in a stigmatized industry, just as marijuana is still labelled a sin sector by some investors today.

The Altria-Aphria rumour lifted several other cannabis stocks, including competitor Cronos Group, which recovered by 16.4% from a day low of $11.28 to close the day trading at $13.12, up 4.65% from Tuesday close. Market leader Canopy Growth’s stock also recovered some of the day’s losses.

Even though Aphria later issued a press release in which it did not confirm nor deny the existence of such high-level business negotiations, the interest created in investors’ minds will linger for much longer and the announcement of a deal could further prop up many cannabis stocks.

Investor takeaway

The long-term outlook for marijuana stocks remains blurry today, as the sector is potentially well overvalued and market hype could quickly vanish if revenues and profitability expectations don’t materialize after October 17 when recreational sales kick off in Canada.

The sector has been known to be very volatile historically, and this may remain the case until earnings results start creeping in by February next year and the investing community gets feedback as to whether the built-in high-growth expectations on the equity prices are indeed achievable.

Otherwise, the whole sector may plunge down to Earth and it may require a full decade until the group of stocks grows back to current valuations.

I wouldn’t consider the Horizons Marijuana Life Sciences Index ETF an investment hedge today, but a speculative investment that could grow in the short term and hold its ground or go bust in the long term.

Fool contributor Brian Paradza has no position in any of the stocks mentioned.