Stock Story - Vocational education Universal Technical Institute (NYSE:UTI) reported results ahead of analysts' expectations in Q1 FY2024, with revenue up 45.6% year on year to $174.7 million. The company's full-year revenue guidance of $715 million at the midpoint also came in slightly above analysts' estimates. It made a GAAP profit of $0.17 per share, improving from its profit of $0.02 per share in the same quarter last year.

Is now the time to buy Universal Technical Institute? Find out by reading the original article on StockStory.

Universal Technical Institute (UTI) Q1 FY2024 Highlights:

- Revenue: $174.7 million vs analyst estimates of $168.3 million (3.8% beat)

- EPS: $0.17 vs analyst estimates of $0.04 ($0.13 beat)

- Raised full year 2024 guidance at the midpoint for revenue, adjusted EBITDA, and adjusted EPS

- Free Cash Flow of $6.99 million, down 84.8% from the previous quarter

- Gross Margin (GAAP): 47.1%, down from 56.7% in the same quarter last year

- New Students: 4,346

- Market Capitalization: $791.5 million

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

Education ServicesA whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Sales GrowthA company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Universal Technical Institute's annualized revenue growth rate of 16.1% over the last 5 years was solid for a consumer discretionary business. Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Universal Technical Institute's healthy annualized revenue growth of 34.9% over the last 2 years is above its 5-year trend, suggesting its brand resonates with consumers.

We can dig even further into the company's revenue dynamics by analyzing its number of New Students, which reached 4,346 in the latest quarter. Over the last 2 years, Universal Technical Institute's New Students averaged 45.8% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's average selling price has fallen.

This quarter, Universal Technical Institute reported magnificent year-on-year revenue growth of 45.6%, and its $174.7 million of revenue beat Wall Street's estimates by 3.8%. Looking ahead, Wall Street expects sales to grow 8.4% over the next 12 months, a deceleration from this quarter.

Cash Is King Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

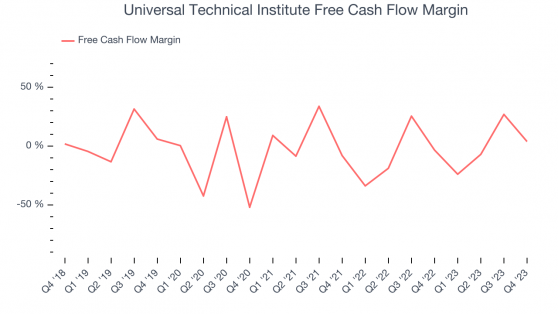

While Universal Technical Institute posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Universal Technical Institute's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 3.7%.

This was a classic 'beat and raise' quarter for the company, with key line items coming in ahead of Wall Street analysts' expectations. The company also raised full year guidance for revenue, adjusted EBITDA, and adjusted EPS (while maintaining previous the full year outlook for new students and free cash flow). Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 4.2% after reporting and currently trades at $15.3 per share.

Key Takeaways from Universal Technical Institute's Q1 ResultsWe were impressed by how significantly Universal Technical Institute blew past analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 4.2% after reporting and currently trades at $15.3 per share.