* First-quarter revenue falls 1.5 pct

* Net loss widens to 68 cents/share

* Shares fall as much as 16.6 pct

(Repeats to fix formatting with no changes to text)

By Ramkumar Iyer

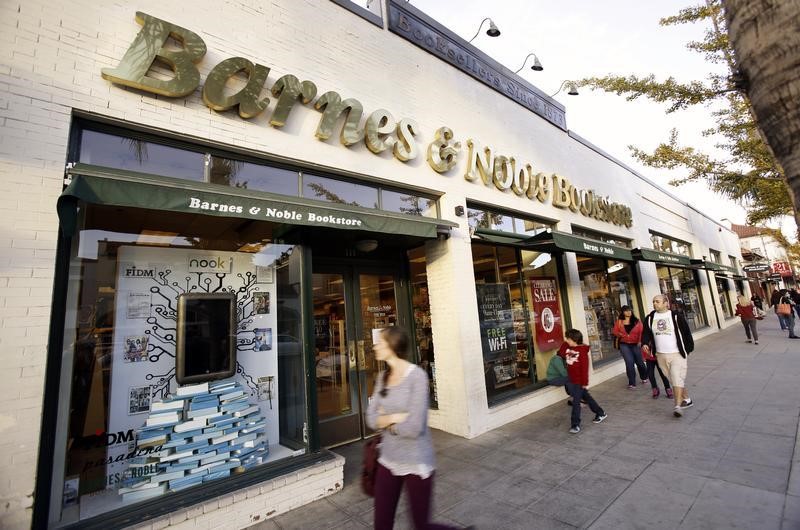

Sept 9 (Reuters) - Barnes & Noble (NYSE:BKS) Inc BKS.N , the largest

U.S. bookstore chain, reported a decline in sales for the fifth

successive quarter as lower demand for its Nook tablets and

online books compounded a protracted slump in sales at its

stores.

The company's shares fell as much as 16.6 percent on

Wednesday.

In recent years, stiff competition from online retailers

such as Amazon.com Inc AMZN.O has eaten into sales at Barnes &

Noble's bookstores and gutted demand for its Nook e-readers.

Despite bold measures to sell a variety of merchandise at

its stores - including toys, signed books and craft brewing kits

- sales at the company's retail division fell 1.7 percent to

$939 million in the quarter ended Aug. 1.

Sales at its Nook business fell 22 percent to $54 million.

Neil Saunders, chief executive of research firm Conlumino,

said Barnes & Noble had failed to replicate its performance in

the preceding quarter when it had managed to stem losses.

Overall, the company posted a bigger first-quarter loss than

a year earlier. ID:nBw1qFk89a

"When taken as a whole, the financials paint a picture of a

company still struggling to make its business model work,"

Saunders wrote in a note.

Comparable retail store sales rose 1.1 percent, driven by

merchandise other than books. The company had 647 stores in the

United States as of Aug. 1, or 11 fewer than a year earlier.

Last month, Barnes & Noble spun off its college books unit

to focus more on its retail bookstores and better integrate its

Nook business. Sales at the college books division rose 5.7

percent in the quarter.

Net loss attributable to Barnes & Noble increased to $34.9

million, or 68 cents per share, from $28.4 million, or 56 cents

per share.

Revenue fell 1.5 percent to $1.22 billion.

Barnes & Noble shares were down 16.6 percent at $13.59 in

late morning trading on Wednesday.