By Alexandra Alper

WASHINGTON (Reuters) - The U.S. Senate is considering including in a new bill to boost competitiveness against China $30 billion in funding for previously-approved measures to supercharge the country's chipmaking industry, a congressional source said on Thursday.

Lawmakers aim to bring the package, which would include other elements to boost the U.S. tech sector, to a full vote in April, the person said, declining to be named because the legislation has not been finalized.

The source, who is involved in the effort, said that the Schumer-led package is likely to have provisions curbing China's access to U.S. capital markets, a focus of the Trump administration's crackdown on Beijing.

A spokesman for U.S. Senate Majority leader Chuck Schumer, who is spearheading the new package, did not respond to a request for comment.

Schumer said last month he had directed lawmakers to craft a new bill to boost U.S. competitiveness against China, based on legislation he and Republican Senator Todd Young proposed last year to provide funding of $100 billion to spur research in key tech areas, from artificial intelligence to quantum computing and semiconductors.

Schumer's office also said the package could be used as a vehicle to provide emergency funding for the bipartisan semiconductor programs included in last year's National Defense Authorization Act, which are still awaiting money.

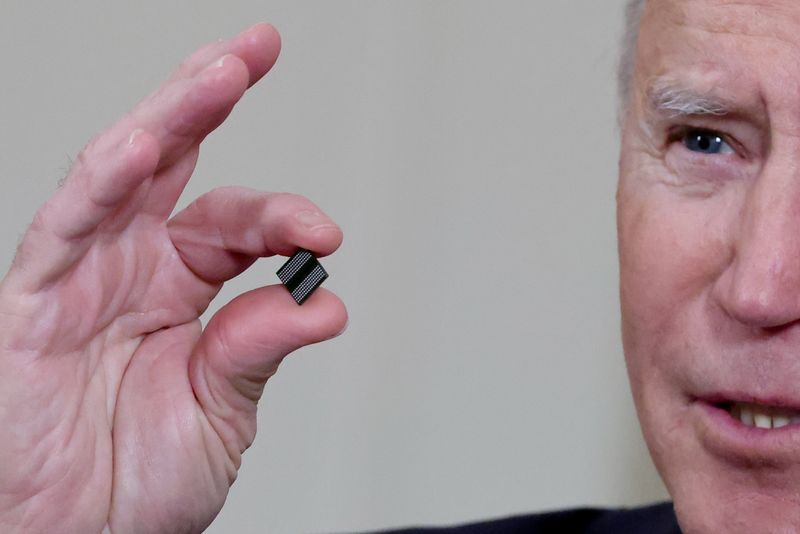

One of those unfunded programs would provide grants to companies investing in U.S. factories and equipment for semiconductor manufacturing, testing, and research and development. Another directs the government to establish a public-private partnership to form consortia of firms to produce "measurably secure microelectronics."

The semiconductor industry has also been pushing for an investment tax credit for spending on semiconductor tools, which can cost billions of dollars for new factories and typically far outstrip the cost of buildings.

The effort comes as U.S. automakers have slowed production on a global shortage of semiconductor chips, in high demand due to a consumer-driven boom in demand for cell phones and computers during the coronavirus pandemic.