By Dhirendra Tripathi

Investing.com – Warby Parker (NYSE:WRBY) stock traded 3% lower Thursday after the eyewear retailer’s 2022 forecast fell short of estimates.

The company said it lost sales of around $15 million to disruption caused by Omicron at the start of the year. It cost the company 3 percentage points of growth, Warby Parker said. The company has, for long, strived to prove that eyewear retailing can be a business of scales and profits.

The company now expects current-year revenue to be $655 million at the midpoint of its guidance range, up 21%. This compares to the 2021 revenue of $541 million, which grew over 37% year-over-year.

WRBY went public through a direct listing on NYSE in September. Its market cap has since halved to $3 billion now.

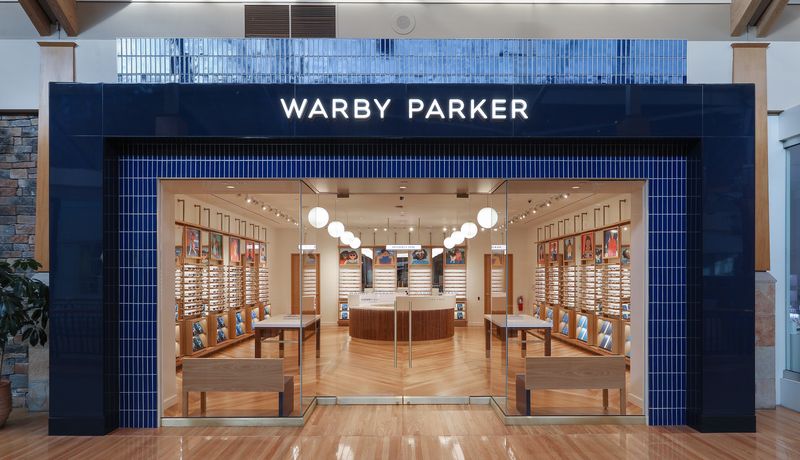

The company closed the year with 161 stores across U.S. and Canada; opened 35 new stores year-to-date, including seven openings in the quarter. It has a unique ‘Buy a Pair, Give a Pair’ program under which it gives a pair to someone in need against every pair of glasses or sunglasses sold.

Margins improved slightly in the quarter due to the scaling up of progressive lenses business, partially offset by increased penetration of contact lenses.

Selling, general and administrative (SG&A) expenses rose due to higher staff compensation and more spending on marketing to push sales in the holidays.

Net revenue jumped 17.8% year-over-year to top $133 million. Net loss was higher by $41.6 million, reaching $46 million due to higher SG&A expenses.