- Positive earnings offset ongoing market risks

- Long-dated U.S. bonds rise more than short-dated notes on inflation concerns

- Crude oil fluctuates

Key Events

US futures contracts for the Dow Jones Futures, S&P 500, NASDAQ and Russell 2000 inched higher on Thursday, with European shares marginally in the green after Wednesday's choppy US session. Markets are pricing in earnings reports as a gauge for the sustainability of the economic recovery, even as such threats as inflation, shrinking stimulus, COVID and China risks hover in the background.

Though all four contracts on the major US indices were up, growth sectors were leading, as NASDAQ 100 futures outperformed. Contracts on the Russell 2000 were the underperformers.

The dollar gained and oil's slump continued.

Global Financial Affairs

This morning, the STOXX Europe 600 Index rose slightly, but remains relatively flat. Belgium-based multinational brewer and beverage maker Anheuser Busch Inbev (BR:ABI) and Swiss travel retailer Dufry (SIX:DUFN), showed that despite inflation, some companies continue to beat expectations.

On the other hand, Royal Dutch Shell (LON:RDSa) missed expectations as the company accelerated its pace to cut carbon emissions. Shares of the oil major dropped 3%.

During the Asia session, most regional benchmarks closed lower. China's Shanghai Composite was the biggest laggard, down 1.25% as worries about the country's troubled property development sector pressured markets, ahead of a looming debt payment deadline for Evergrande (HK:3333). On the other side of the regional market spectrum, South Korea's KOSPI and Hong Kong's Hang Seng outperformed, both down only 0.5%

On Wednesday, stocks on Wall Street retreated from all-time highs. The S&P 500 Index and Dow Jones Industrial Average fell while the NASDAQ Composite closed flat after posting all-time highs on Tuesday.

The NASDAQ 100 hit an all-time intraday high but barely managed to finish with a gain. Still, it was the only major index to finish in positive territory, as Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) rose to records after beating quarterly earnings estimates.

Electric vehicle maker Tesla (NASDAQ:TSLA) locked in the highest closing price in its history, presumably still benefitting from the excitement surrounding its deal with Hertz (OTC:HTZZ).

The Russell 2000 was the session underperformer, -1.9%, the sharpest downturn for the small cap index since September.

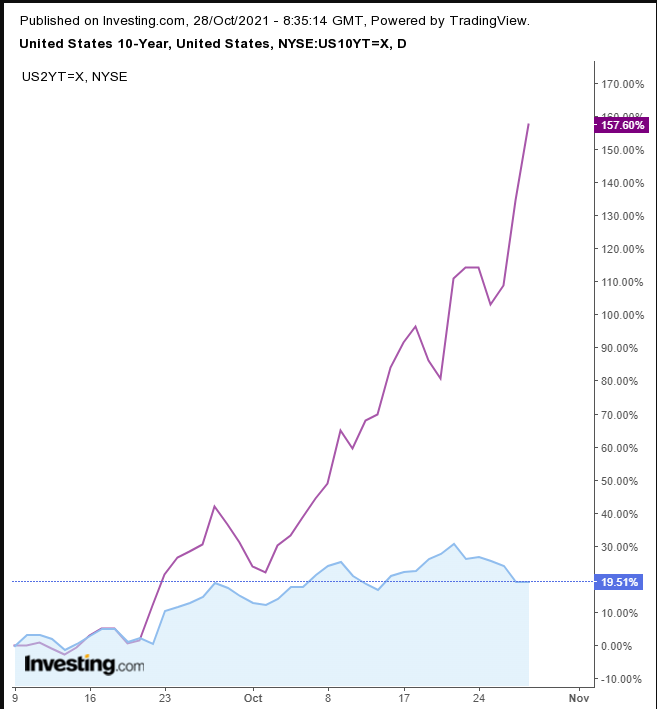

Long-term Treasuries, including the 10-year note resumed outperforming shorter-dated notes as investors continued searching for protection against inflation.

As can be seen by the yield curve on US Treasuries, 2-year yields have surged compared to rates on the 10-year benchmark, indicating that investors have been moving their capital from shorter-dated bonds to longer-term instruments for safety.

Still, global shares remain near all-time highs thanks to solid earnings this quarter, as profit margins widened despite rampant inflation. It's now up to policymakers to maintain calm in markets and avoid a loss of investor confidence.

All eyes are now on today's ECB policy meeting as well as the US's economic growth via the upcoming GDP print, which is predicted to show economic expansion has slowed. Earlier, the Bank of Japan kept its policy intact.

After earlier declining, the dollar firmed.

Nevertheless, it's still trapped in congestion, making the current move insignificant.

Gold advanced for a third straight day.

Technically, the yellow metal is climbing within a daily rising channel while confronting the resistance of a weekly H&S continuation pattern.

Bitcoin rebounded after a two-day drop, making up for yesterday's losses.

This rise may be part of a return move. The price tested the neckline of an H&S top, which pushed the digital coin out of its rising channel.

Oil gapped down on the daily chart, then pared most of its losses.

On the 4-hour chart, above, WTI may be developing an H&S top.

Up Ahead

- Germany's Q3 GDP data is released on Friday

- US PCE Price Index figures are published on Friday as well

Market Moves

Stocks

- The S&P/TSX Composite Index was up 0.2%

- The Stoxx Europe 600 was little changed

- Futures on the S&P 500 rose 0.2%

- Futures on the NASDAQ 100 rose 0.2%

- Futures on the Dow Jones Industrial Average rose 0.2%

- The MSCI Asia Pacific fell 0.4%

- The MSCI Emerging Markets Index fell 0.3%

Currencies

- The CAD/USD was little changed at 0.8094 per U.S. dollar

- The Dollar Index was little changed

- The euro was little changed at $1.1611

- The Japanese yen rose 0.2% to 113.61 per U.S. dollar

- The offshore yuan was little changed at 6.3931 per U.S. dollar

- The British pound rose 0.2% to $1.3766

Bonds

- The yield on Canada's benchmark advanced to 1.696%

- 10-year Treasuries advanced one basis point to 1.56%

- The yield on 10-year Treasuries advanced one basis point to 1.56%

- Germany's 10-year yield increased three basis points to -0.15%

- Britain's 10-year yield rose three basis points to 1.01%

Commodities

- Brent crude fell 1% to $83.74 a barrel

- Spot gold rose 0.4% to $1,803.13 an ounce