- Fed's Bostic urges slower path to higher rates

- Treasury demand eases

- Dollar recovers

Key Events

Global stock markets and futures on the Dow Jones, S&P 500, NASDAQ 100, and Russell 2000 rebounded slightly on Wednesday after comments from Atlanta Fed President Raphael Bostic called for caution on upcoming rate hikes saying they could create "significant economic dislocation." With the FOMC minutes from the Fed's May meeting set to be released at 1400 EDT later today, investors will be able to sift through the central bank's language for additional clarity on current policy decisions along with possible clues regarding upcoming rate hikes.

Gold slid on dollar strength.

Global Financial Affairs

All four US futures contracts were trading slightly in the green this morning on the potential shift in policy at the Fed. Markets have been roiled significantly by interest rate concerns since December when the Fed turned hawkish.

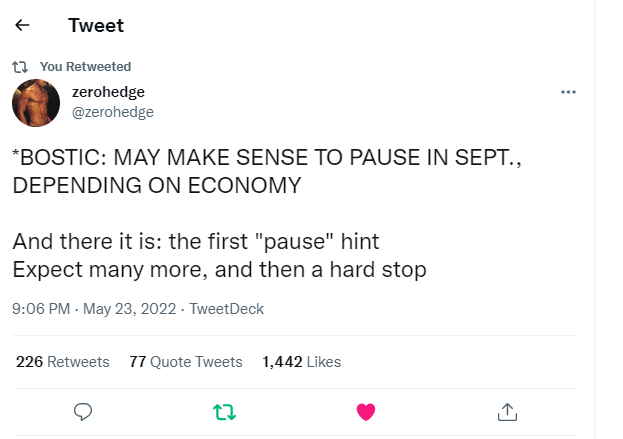

Bostic's comments that it would be wise to pause interest rate hikes in September after two additional 50 basis point increases, were in sharp contrast to comments from Fed Chair Jerome Powell last week when he emphatically announced that the US central bank would not stop raising rates until there's proof inflation is declining steadily.

Some market players scoffed at what they consider to be empty promises from Bostic; we understand their skepticism as the Fed has flip-flopped in the past.

But his comments may be the first indication of a change of opinion at the US central bank.

Traders' optimism may have also been boosted by comments from Bank of America's CEO Brian Moynihan that US consumers—who account for 70% of GDP—will keep spending as they're in "good shape." Interestingly, Jamie Dimon, CEO of JP Morgan has softened his earlier dire outlook for the US economy saying that although there are storm clouds, they "may dissipate".

In Europe the STOXX 600 Index climbed slightly with miners and utilities after the GfK Consumer Climate index eased slightly after languishing at an all-time low. German GDP came in as expected, both on a quarterly and annual basis.

China's Shanghai Composite led among the gainers in Asia, with traders placing their hopes in a government that has repeatedly been vowing support.

In Japan, the Nikkei 225 was the only regional significant index in negative territory as it seemed that Tokyo's stock exchange tracked Wall Street's selloff, but it is unclear why it was the only index to do so.

Almost all US stocks closed lower Tuesday, though gains by defensive companies pared losses. Technology continued to lead the downward spiral after weak guidance by Snap (NYSE:SNAP) cost shares in the social media giant 40% and infected the entire sector.

Homebuilders also declined after weak data on US home sales. Although Manufacturing PMI met expectations, Services PMI fell short, adding another blow on the economic front.

A rush of demand for Treasuries—which pushed 10-year yields to near-monthly lows—stabilized as the sovereign bonds tested the bottom of the left shoulder of a small H&S top.

However, it could turn out that we prematurely drew the neckline. Perhaps the pattern is just a regular H&S top, not an upward-sloping H&S, which means another bounce may convince us to reposition the right shoulder.

The dollar opened higher and extended an advance that wiped out yesterday's rout.

Right now, the greenback is testing the trendline connecting recent hourly highs. An upside breakout would also test the potential resistance of the hourly low of May 4 (dotted red line). If the price breaks through the 102.35 level, we expect it to test the top of the rising channel (which may be by then at the same level). The short term remains down amid a long-term uptrend.

Gold fell on dollar strength as it compounded risk.

Technically, Monday's Shooting Star held resistance amid the Rising Channel.

Bitcoin rose for the second day, though its advance was trimmed. Anecdotally, Miami Mayor Francis Suarez said he continues to get paid in Bitcoin, even after the near-40% decline. However, he qualified the statement by saying his city salary isn't his only salary, and he might have made a different decision if it was.

According to a bearish Pennant, the price of the cryptocurrency continues to trade in a converging pennant, though we're concerned the pattern may have lost its strength as the price wavers aimlessly through its apex.

Up Ahead

- The US releases GDP figures on Thursday.

- On Thursday, initial jobless claims are printed.

- On Friday, the US PCE price index is published.

Market Moves

Stocks

- The MSCI Asia Pacific Index fell 1%

- The MSCI Emerging Markets Index fell 1.7%

Currencies

- The euro fell 0.6% to $1.0673

- The Japanese yen rose 0.2% to 127.11 per dollar

- The offshore yuan rose 0.4% to 6.6845 per dollar

- The British pound fell 0.3% to $1.2491

Bonds

- Germany's 10-year yield declined two basis points to 0.94%

- Britain's 10-year yield rose slightly to 1.89%

Commodities

- Brent crude rose 1.1% to $112.00 a barrel

- Spot gold fell 0.6% to $1,855.24 an ounce