- Russell 2000 futures outperformed

- Markets await US tapering

- Bitcoin recovers

Key Events

On Tuesday, US contracts on the Dow, S&P, NASDAQ and Russell 2000 were mixed ahead of the US session and shares in Europe declined as the global supply chain quagmire deepened and China introduced new coronavirus restrictions. In an attempt to resolve the supply chain constraints US President Biden called on global leaders to try and diversifying the supply chain ecosystem to avoid additional disruptions to commerce across the globe.

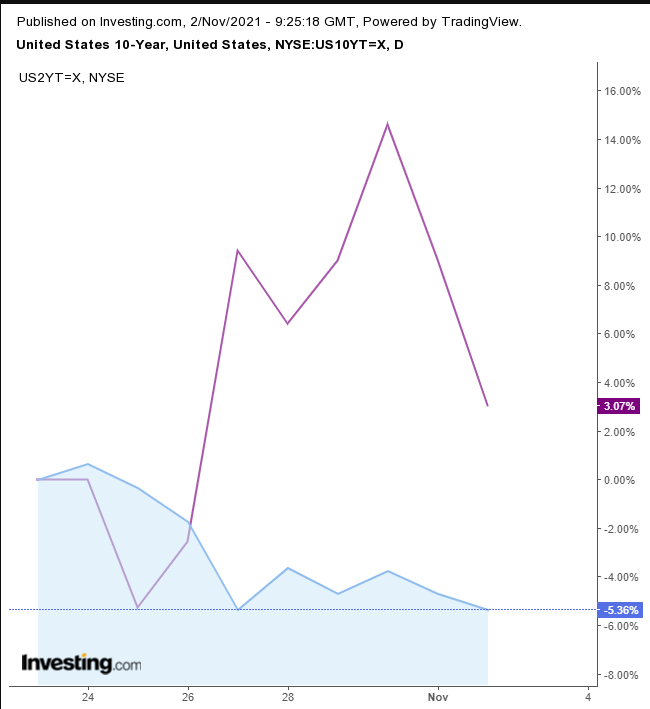

The Treasury yield curve flatted ahead of the Federal Reserve's monthly policy meeting.

Global Financial Affairs

Futures on the S&P 500 and NASDAQ were in the red while Dow and Russell 2000 futures were trading higher. On Monday, the small cap Russell 2000 surged 2.6% during Wall Street trade; the tech-heavy NASDAQ was the second best performer, adding just 0.6%.

In Europe, shares fell from record levels led by miners, pressured by a slump in iron ore prices. The STOXX 600 Index fell out of the gate this morning after closing at a record high yesterday following strong corporate results and a jump in bank stocks as expectations increase that the European Central Bank will raise rates.

Trading in Asia was mostly lower, with Japan's Nikkei 225 losing 0.4% and Australia's ASX slipping 0.6%. China's Shanghai Composite declined 1.2%, after social restrictions were introduced there due to an increase in coronavirus cases. Hong Kong's Hang Seng slid 0.1% while South Korea's KOSPI was the only bright spot, gaining 1.1%.

Bond and foreign exchange traders are bracing ahead of the two-day Fed meeting which starts today. It is widely anticipated the US central bank will announce the first step in the reduction of its stimulus program. On the other hand, equity traders appear to be fixated on corporate earnings and are mostly ignoring macroeconomics.

The Treasury yield curve flattened after earlier steepening, as 2-year yields plunged 2.3 basis points. Yields are see-sawing between inflation worries about and lower growth prospects due to labor shortages and supply-chain disruptions. Inflation concerns appear to be winning.

The move narrowed the gap to 10-year Treasury yields which declined by less than one basis point.

The dollar wavered but is currently holding steady.

The greenback is being squeezed between the long-term uptrend and the short-term downtrend, clearly defined by the rising and falling channels.

Gold is also flat.

The precious metal is attempting to hold on to its short-term uptrend, a return-move to a weekly H&S continuation pattern.

Bitcoin rallied for the first time in four sessions.

The cryptocurrency is within a potential small H&S bottom.

Oil fluctuated between gains and losses.

Up Ahead

- On Tuesday Canada releases its monthly Building Permits data

- On Thursday OPEC+ meets to decide on output.

- The Bank of England announces its rate decision on Thursday.

- Initial jobless claims in the US are published on Thursday

Market Moves

Stocks

- The S&P/TSX Composite fell 0.1%

- The STOXX 600 fell 0.2%

- Futures on the S&P 500 were little changed

- Futures on the NASDAQ 100 fell 0.1%

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index fell 0.2%

- The MSCI Emerging Markets Index was little changed

Currencies

- The Canadian Dollar was slightly lower at $0.8064

- The Dollar Index was little changed

- The euro was little changed at $1.1603

- The Japanese yen rose 0.3% to 113.65 per dollar

- The offshore yuan was little changed at 6.3944 per dollar

- The British pound fell 0.1% to $1.3649

Bonds

- The yield on Canada's benchmark Canada 10-Year was little changed at 1.75%

- The yield on 10-year Treasuries was little changed at 1.56%

- Germany's 10-year yield declined two basis points to -0.12%

- Britain's 10-year yield fell two basis points to 1.04%

Commodities

- Brent crude rose 0.2% to $84.92 a barrel

- Spot gold fell 0.1% to $1,791.07 an ounce