I originally planned to write this piece regarding my greatest fear about inflation and the U.S. economy in mid-February. At the time, It was supposed to be about a hypothetical worst-case scenario for the U.S. economy, which I was hoping would never occur. In case you missed Part One in this series, you can read it here.

On February 24, Russia invaded Ukraine, and in my view, this changed the worst-case scenario to the most likely scenario. What does this mean?

It Will Get Worse Before It Gets Better

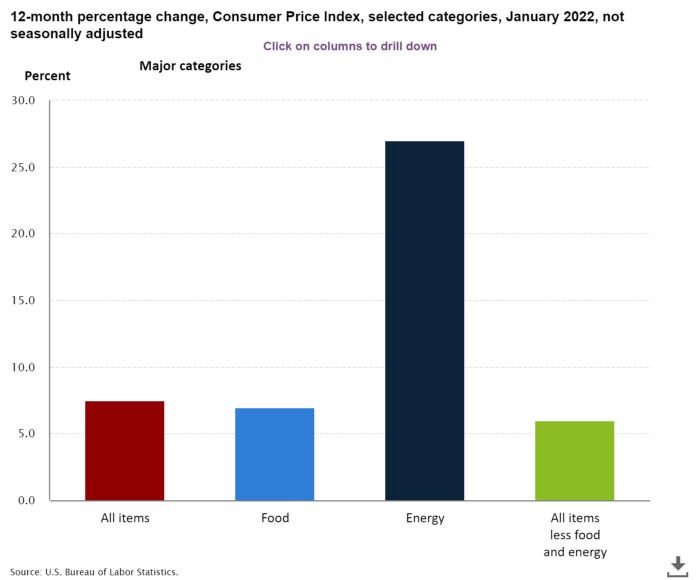

Let’s look at a summary report of January consumer inflation, called the CPI (Consumer Price Index). The figures I refer to in this piece are year-over-year, meaning prices are compared to figures from January 2021.

- Overall consumer inflation: 7.5%

- Energy inflation: 27%.

- Food inflation: 7%

- Core inflation (all items other than food and energy): 6%

Why is this a big deal?

The U.S. central bank, the Federal Reserve, or Fed for short, has a target to keep inflation at 2%, thus balancing economic growth and inflation.

Normally, there is a cycle regarding inflation that the Fed tends to follow.

When the Fed eases its monetary policy by lowering interest rates or quantitative easing (money printing), the economy tends to heats up, and unemployment tends to go down. If this is taken too far, inflation goes above 2% and then the Fed is supposed to tighten its monetary policy by increasing interest rates and hypothetically removing cash from the economy. The Fed plans to start tightening soon..

It should be noted that the majority of “cash” or “money” I am referring to is digital, not physical paper cash or coin. It still works in the same way. Read this for a deeper dive into inflation and central bank monetary policy.

My greatest fear is that an additional factor is leading the way on inflation, and it’s something that is out of the Fed’s control.

In the 1970s, interest rates were increased and it did not get inflation under control. The economy in the U.S. and other advanced economies stagnated despite the high inflation. Economists believe this was caused by skyrocketing oil prices.

This was known as stagflation. The consequences for the average person could be disastrous.

Supply & Demand

Here is a simple formula:

Supply and demand can be seen to control price.

If supply and demand remain steady, price is expected to be steady.

If supply and demand both go up together, or both go down together, price is expected to be steady.

If supply goes up and demand remains steady, price is expected to go down a little. If supply goes up and demand goes down, price is expected to go down a lot.

If supply goes down and demand remains steady, price is expected to go up a little. If supply goes down and demand goes up, price is expected to go up a lot.

Energy Inflation: Supply & Demand

In this piece, I will dive into how the supply and demand of the U.S. oil and gas industry relates to inflation, what actions the U.S. government has taken on this industry in the past year and what the results have been and what I project will occur if these actions continue.

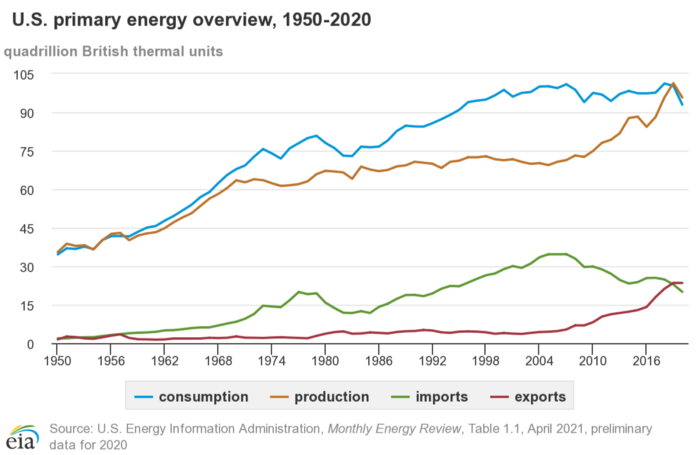

Per the Energy Information Administration (EIA), the U.S. became “energy independent” in 2019 and maintained this in 2020. In other words the U.S was a net exporter of oil & gas in 2019 and 2020 for the first time since the 1950s.

Per a recent article in Barron’s, the U.S. imported about 8% of its oil and refined products from Russia in 2020. The majority of oil the U.S. imports is purchased from Canada, Mexico, and Saudi Arabia, however the imports of Russian oil has increased over the last few years.

U.S. Government Actions

President Joe Biden assumed office on January 20, 2021.

On his first day, he issued an Executive Order targeting the oil & gas industry and followed this up with numerous Executive Orders on the subject:

- The Keystone Pipeline was canceled.

- The leasing of federal land for drilling of new oil and gas was suspended.

- Existing leases in Alaska for drilling oil and gas were suspended.

- Specific offshore lease sales in the Gulf of Mexico were canceled.

The target was to decrease the negative effects on the environment caused by drilling for more oil and gas.

The 2021 Infrastructure Bill passed in 2021 mainly focused on wind and solar investments, and much of these are renewal of existing tax credits. Hydroelectric power is noticeably absent. Hydro, as an example, produces 18% of the world’s energy and 54% of its renewable energy. It produces 95% of the energy for the Province of Quebec, Canada.

The Biden Administration’s actions affect the long-term ability of the U.S. to produce its own energy, and will drive the nation to import its energy, unless it is replaced by domestic sources of energy first.

The 2021 export-import figures are not yet available, however it appears that these policy actions have not affected prices in the short-term to a great extent, yet. Review of the figures from the EIA’s website shows that supply of oil and gas has decreased, production has remained somewhat steady and demand has increased, as the US economy has re-opened and continues to re-open following the pandemic.

The timing of winding down the oil and gas industry combined with the re-opening of the US economy may prove to be catastrophic.

It is possible that markets have priced in these actions for the future, and it is also possible that the worst is yet to come. One could also ask, how many years will it take for investments in wind and solar to replace oil and gas? And will this ever be effective?

Our Projected Course

In Europe, moving away from oil and gas before replacing it domestically has had two negative effects:

- Higher energy costs.

- Dependence on Russian oil and gas. 45% of the EU’s gas imports came from Russia in 2021.

It appeared that the worst-case scenario for the US was to be heading in this direction. Then on February 24, Russia invaded Ukraine, making it the most likely course.

Unprecedented sanctions have been levied against Russia by the US, Canada, EU, UK, Japan and other nations. Still, these nations have stopped short of banning the purchase of Russian oil, possibly the most brutal sanction of all. This would of course hurt Russia’s economy as well as the economies of those countries dependent on Russian oil.

Editor’s Note: On March 8, 2022, U.S. President Joe Biden banned the import of Russian oil and gas.

On March 3, Senators Joe Manchin (D-WV) and Lisa Murkowski (R-AK) proposed bi-partisan legislation that would ban purchasing Russian oil. While there are discussions about an oil embargo against Russia, oil prices have skyrocketed.

If the Biden admin continues current energy policy of limiting US production of oil and gas, and importing oil to meet demand, I project three likely scenarios:

- Inflation gets much worse.

- Stagflation results.

- The economy goes into a recession, and deflation occurs.

Is there a Way Out?

As Russia has invaded Ukraine, any short-term good outcome seems unlikely unless diplomacy can be successfully applied by either nation or a foreign power.

A proposal to the Biden Administration that would result in a better long-term solution for the U.S could be:

- Immediately increase domestic oil and gas production, achieving stable energy independence. This benefits the U.S. economy, foreign policy, military and national security.

- Invest in renewable energy capable of replacing coal, oil and gas. Add more focus to hydroelectric power.

- Phase out of coal as the first priority, then oil.

This article was originally published on https://thelatestblock.com/