While global economic growth is expected to slow down, these two top growth stocks are continuing to grow at an incredible rate. Investors with a long-term investment horizon will benefit the most from buying these stocks over time for compounded growth.

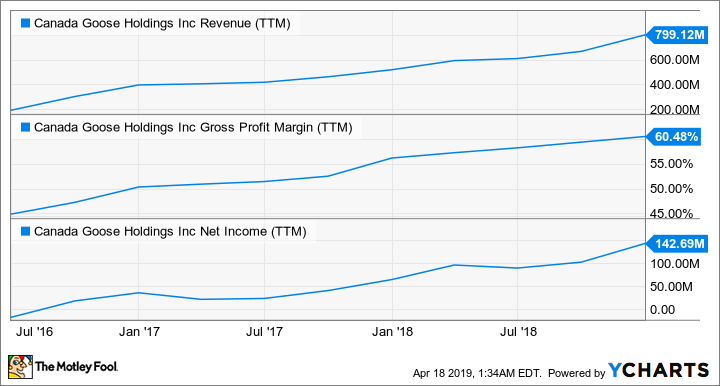

Canada Goose Holdings (TSX:GOOS)(NYSE:GOOS) Canada Goose is a goose that lays golden eggs. In the last three years, its revenue increased at a compound annual growth rate of 39%. Last year, Canada Goose increased revenue by 46% to a record of $591 million. The higher top-line growth is a good sign.

From fiscal 2015 to 2018, Canada Goose’s net income climbed from $14.4 million to $96 million, improving net margins from 6.6% to 16.2%. In the period, Canada Goose also generated very high double-digit returns on equity between 18% and 50%. The trailing 12-month return on equity and return on assets were strong at 45% and 17%, respectively.

Higher revenue plus expanding margins is a great formula for higher profitability.

GOOS Revenue (TTM) data by YCharts

The consolidation in Canada Goose stock since mid-2018 has created an excellent opportunity to buy the growth stock at a reasonable valuation. At about US$52.73 per share, the stock trades at a price-to-earnings ratio of about 53.8 and is estimated to increase earnings per share by 28-35% per year over the next three to five years.

Shopify (TSX:SHOP)(NYSE:SHOP) Shopify is like a mini version of Amazon (NASDAQ:AMZN) in terms of its growth characteristics. For the longest time, many analysts and investors thought Amazon stock was super expensive, but the growth stock only headed higher over time.

An investment in Amazon from 2001 has returned nearly 120 times the investment. It’s hard to grasp that math. In concrete numbers, $10,000 turned into nearly $1.2 million, delivering roughly annual total returns of 30%!

Looking at Amazon from a cash flow multiple perspective makes it much more palatable. Since fiscal 2013, Amazon has experienced operating cash flow per share growth of 10-69% per year. And its normal cash flow multiple is about 26.

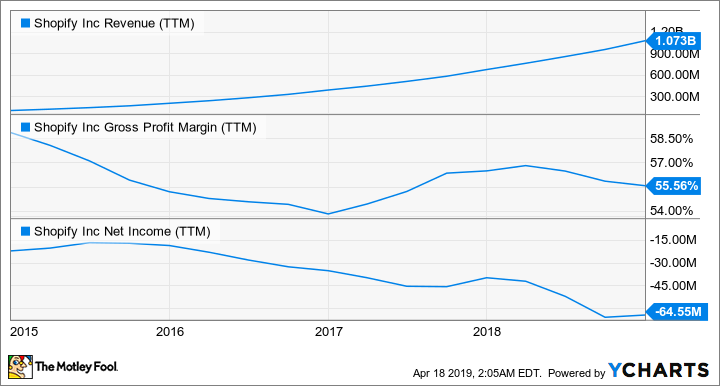

Shopify has strong stock price persistence and growth momentum, which is essential for a growth stock. In the last three years, its revenue increased at a compound annual growth rate of 73%. In the last fiscal year, revenue increased by 59% to a record of US$1 billion.

SHOP Revenue (TTM) data by YCharts

Shopify hasn’t exactly turned a profit yet. However, that’s partly because it continues to invest heavily in the business to increase market share. Essential areas of investment include talents, technology, and marketing.

At US$217 per share, Shopify is indeed super expensive, trading at a forward cash flow multiple of about 409.

Foolish takeaway Between the two top growth stocks, Canada Goose stock is the lower-risk buy right now, as it’s trading at a reasonable price and is in consolidation mode. Shopify stock has run up 56% year to date and is super expensive. So, it’d be safer to buy after it has consolidated or dipped meaningfully.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Fool contributor Kay Ng owns shares of Canada Goose, Amazon, and Shopify. David Gardner owns shares of Amazon. Tom Gardner owns shares of Shopify. The Motley Fool owns shares of Amazon, Shopify, and Shopify. Shopify is a recommendation of Stock Advisor Canada.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2019