(Bloomberg) -- Welcome to Tuesday, Asia. Here’s the latest news and analysis from Bloomberg Economics to help get your day started:

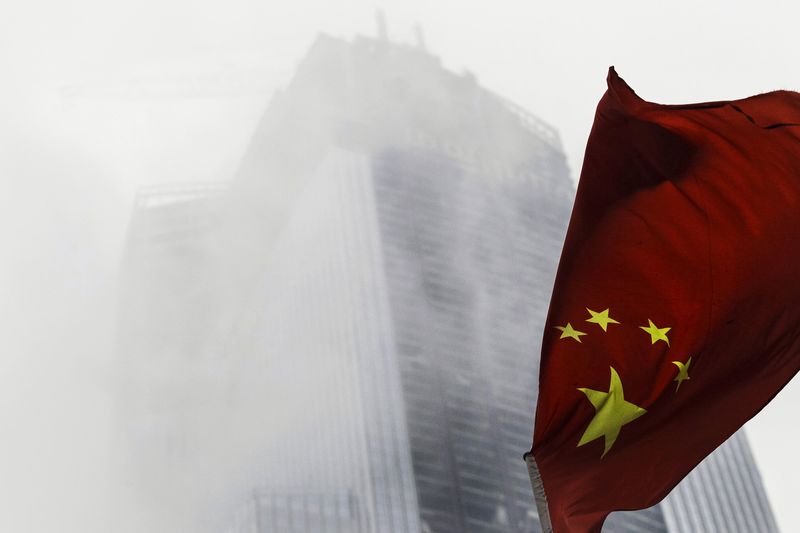

- China’s economy slowed for an eighth straight month as weaker global demand and decelerating factory inflation undercut growth, early data show

- The Trump administration will press China to show it can live up to its promises in trade talks this week, says Treasury Secretary Steven Mnuchin. U.S. protectionism will hurt rather than help the economy, according to a Congressional Budget Office forecast that’s at odds with President Trump’s position

- U.S. borrowing needs are rising faster than previous estimates as the Trump administration finances a widening budget deficit. Meantime, the government shutdown will ultimately cost the economy $3 billion

- Mario Draghi said that while the euro-area is looking bleaker than anticipated, it’s not bad enough to warrant additional monetary support. However, Jamie Murray argues lower underlying economic growth raises the chances of a recession and downside risks loom

- Those betting the Federal Reserve will cut interest rates may have to wait until 2023 to see it, Congress’s in-house forecasting unit suggested. Separately, the release of U.S. GDP, trade and income reports will be delayed this week and next due to the shutdown

- Japan appears to be trying to let some steam out of the property market, an area showing signs of imbalances from massive stimulus

- Pressure is building on India’s central bank to pay part of its profits to the government to fund spending before a crucial election. The main opposition Congress party has meantime promised to implement a minimum income guarantee program for the poor