By Ambar Warrick

Investing.com-- Chinese and Hong Kong stocks led losses across Asia on Thursday, pulled lower by major real estate developers after a dire profit warning from Country Garden Holdings.

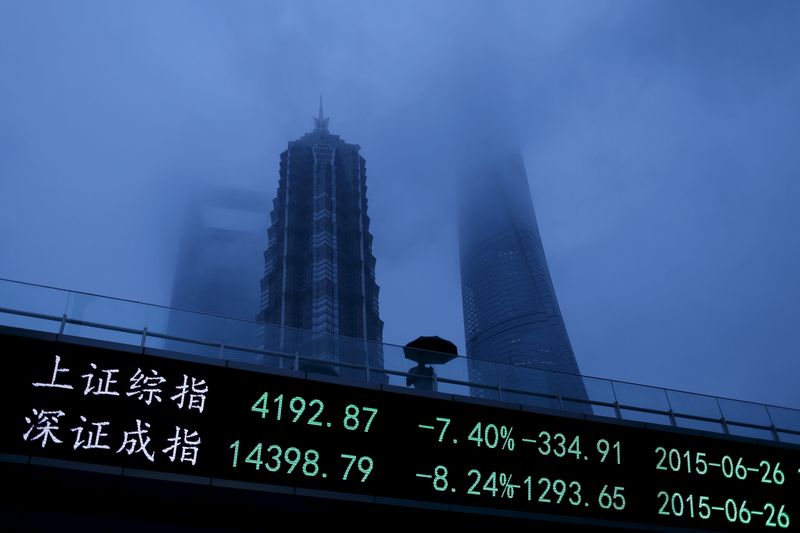

China’s bluechip Shanghai Shenzhen CSI 300 index sank 0.9%, while Hong Kong’s Hang Seng index shed 0.7% by 23:52 ET (03:52 GMT). The Shanghai Composite index fell 0.5%.

Country Garden Holdings Company Ltd (HK:2007) was the worst performer in Hong Kong, losing over 5% after the property developer warned that its profit for the first half of 2022 was expected to sink to between 200 million yuan and 1 billion yuan ($29.5 million and $147.5 million), down from 15 billion yuan a year ago, amid severe headwinds in the real estate market.

Other real estate firms, including Cinda Real Estate Co Ltd (SS:600657), Gemdale Corp (SS:600383) and Shantui Construction Machinery Co Ltd (SZ:000680) shed over 2% each. Steelmaker HBIS Co Ltd (SZ:000709) lost nearly 3%.

Country Garden’s warning indicates more trouble for China’s debt-saddled real estate sector. A downturn in the sector could potentially spill over to other aspects of the Chinese economy.

China is already struggling with slowing economic growth this year, stemming from a series of COVID-19 lockdowns. This has seen the government roll out a swathe of stimulus measures to help support growth.

Broader Asian stocks also fell on Thursday, tracking a weak lead-in from Wall Street after softer-than-expected earnings from Target Corporation (NYSE:TGT). Traders were also digesting signals from the Federal Reserve that it eventually plans to lessen the pace of interest rate hikes as inflation comes closer to its target range.

Japan’s Nikkei 225 lost 0.9%, while South Korea’s KOSPI benchmark fell 0.5%.

Australia’s ASX 200 index fell 0.3% after data showed the country’s job market unexpectedly shrank in July. But Australia’s unemployment rate also fell to a 48-year low.

Philippine stocks were flat ahead of a widely-anticipated interest rate hike by the central bank later in the day. The bank is expected to raise rates by 50 basis points to 3.75%.