By Peter Nurse

Investing.com - U.S. stocks are seen opening lower Friday, consolidating after a four-day rally, with investors keeping a wary eye on the race for the White House ahead of the release of key employment data.

At 7:05 AM ET (1205 GMT), S&P 500 Futures traded 20 points, or 0.6%, lower, the Dow Futures contract fell 120 points, or 0.4%, while Nasdaq 100 Futures dropped 94 points, or 0.8%.

The Dow Jones Industrial Average closed 2% higher Thursday, while the S&P 500 index climbed 2%, and the Nasdaq Composite index added 2.6%. These indices are on course for their best week in seven months, with the Dow and S&P up over 7% this week so far and the Nasdaq Composite 9% higher.

The U.S. presidency race is still ongoing, but the tide appears to be turning decisively in favor of Democrat candidate Joe Biden. The former vice president has taken a narrow lead in vote-counting in Georgia, according to a number of U.S. news outlets, one of the states that incumbent President Donald Trump needs to win to retain his place in the White House.

While Biden now seems likely to become president, the Senate still seems set to stay in Republican hands. This would reduce the prospects of substantial regulatory changes, given a divided Congress, but could also make a substantial coronavirus relief fund tricky to pass.

“Indications point to a Joe Biden presidency, absent the 'blue wave' that markets had been anticipating. Political animosity means a substantial near-term fiscal support package is less likely at a time when incomes are being squeezed and rising Covid-19 cases mean containment measures are looking more likely. Economic risks are mounting,” said ING analyst Carsten Brzeski, in a research note.

Meanwhile, seventeen out of 50 U.S. states reported record one-day increases in coronavirus cases on Thursday, according to a Reuters tally, a day after the country recorded over 100,000 new infections for the first time.

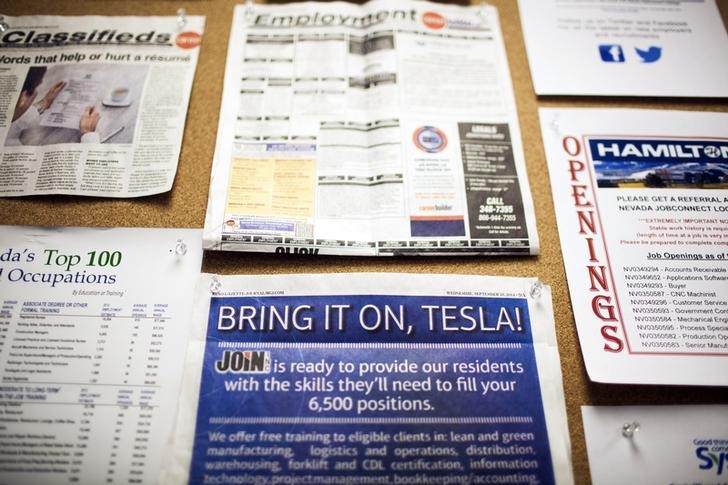

This increase in Covid cases will place an increased focus upon the October jobs report, at 8:30 AM ET (1230 GMT), with nonfarm payrolls expected to show a gain of 600,000, which would be lower than September’s 661,000.

CVS Health (NYSE:CVS), Marriott International (NASDAQ:MAR) and Hershey (NYSE:HSY) all beat expectations for their quarterly earnings earlier, while Coty (NYSE:COTY) and others are still to report.

Oil prices fell Friday, under pressure from signs of overproduction within OPEC and more aggressive discounting by Saudi Arabia in Asia.

U.S. crude futures traded 3.3% lower at $37.51 a barrel, while the international benchmark Brent contract fell 2.7% to $39.84. These contracts are still heading for their first weekly gain in four.

Elsewhere, gold futures rose 0.5% to $1,955.70/oz, but remained on course for its biggest weekly gain since July, while EUR/USD traded 0.5% higher at 1.1881.