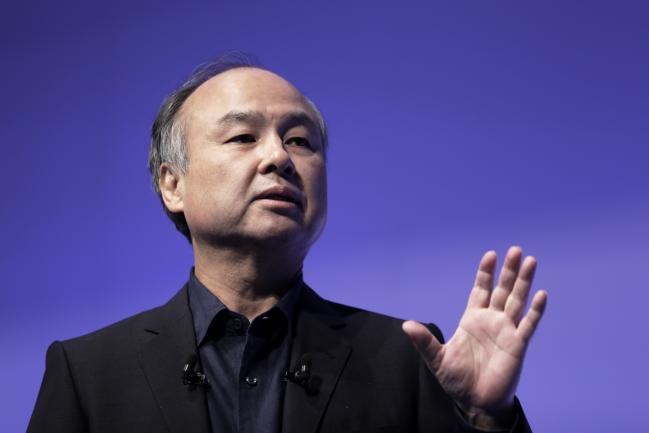

(Bloomberg) -- Elon Musk and Masayoshi Son held talks last year about SoftBank Group Corp. investing in Tesla (NASDAQ:TSLA) Inc., including potentially taking the electric carmaker private, according to two people with knowledge of the discussions.

Son and Musk met in April 2017 to discuss an investment in Tesla, the people said. The talks touched on taking Tesla private, but failed to progress due to disagreements over ownership. Musk proposed a structure that would have given him disproportionate control over the company through stock with supervoting rights, one person said. There are no active talks between the companies now, said the people, who asked not to be identified discussing private deliberations. Tesla spokesmen didn’t immediately respond to requests for comment on Wednesday. A SoftBank spokesman declined to comment.

At the time of the talks, Tesla was trading at just over $300 a share. The shares surged 11 percent to $379.57 on Tuesday after Musk said he’s considering taking Tesla private at $420 a share, or an enterprise value of about $82 billion. He currently owns 20 percent of the company, so more than $60 billion is needed to buy the business from public shareholders.

Japan’s SoftBank and its $100 billion Vision Fund often pay handsomely for large stakes in technology companies. In return, they like a say in the management of the businesses they back. Saudi Arabia’s Public Investment Fund, a major backer of the Vision Fund, has built a $2 billion stake in Tesla already.

An acquisition of Palo Alto, California-based Tesla by overseas investors would likely trigger a national-security review by the Committee on Foreign Investment in the U.S. The panel, which has stepped up its scrutiny and blocked some deals lately, could impose conditions, including limits on control of the company and information sharing.

"Most of the obvious funding sources for Tesla’s take-private transaction are foreign-based," Toni Sacconaghi, an analyst at Sanford C. Bernstein & Co., wrote in a note. "We imagine the Committee on Foreign Investment in the U.S. would likely object to any foreign investor buying a significant portion of a distinctively American manufacturer such as Tesla"

Still, SoftBank is familiar with CFIUS. The company’s 2017 agreement to buy U.S.-based robotics firm Boston Dynamics was reviewed by the panel. In another deal, CFIUS forced SoftBank to relinquish day-to-day control of Fortress Investment Group before approving that $3.3 billion purchase, the Financial Times reported earlier this year.