By Andrew Galbraith

SHANGHAI, Nov 2 (Reuters) - Asian equity markets rose on Friday as China and the United States expressed optimism about resolving their bruising trade war, though a warning from tech giant Apple Inc on holiday sales amid emerging market weakness could weigh on technology shares.

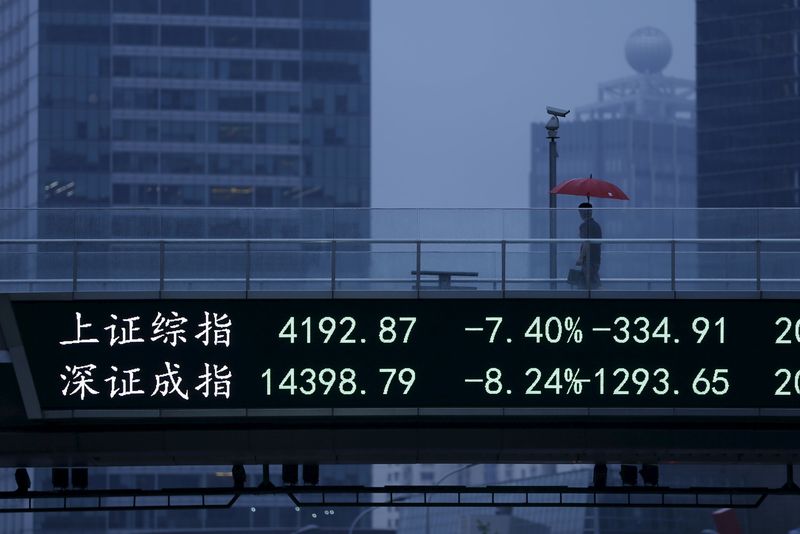

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.46 percent, adding to the previous session's strong gains. But that came after a sharp 10.3 percent dive in October, its worst month since August 2015.

Australian shares .AXJO were down 0.18 percent, while Japan's Nikkei stock index .N225 was up 1.27 percent.

The improved mood in early Asian trade followed a rise in U.S. shares overnight, with the Dow Jones Industrial Average .DJI and the S&P 500 .SPX each gaining 1.06 percent while the Nasdaq Composite .IXIC rallied 1.75 percent.

A combination of bargain-hunting following steep losses in equities last month and some strong corporate earnings have helped power Wall Street's bounce. Investors also lapped up news that the leaders of the world's two largest economies may be ready to take concrete steps to resolve their bitter trade dispute - one of the major factors behind a rout in riskier assets recently.

U.S. President Donald Trump said trade discussions with China were "moving along nicely" and his Chinese counterpart Xi Jinping expressed hopes of expanding the bilateral trade cooperation.

Trump said he planned to meet with Xi at an upcoming G-20 summit the same, underscoring risks around Sino-U.S. trade relations, a U.S. Justice Department indictment said companies based in mainland China and Taiwan had conspired to steal trade secrets for a U.S. semiconductor firm. there was also enough uncertainty to go around for investors, with slowing factory growth around the world adding to worries about the outlook for corporate earnings, business investment and trade.

Data from the U.S. also showed cooling manufacturing activity in October as a measure of new orders hit a 1-1/2 year low. That came after manufacturing surveys showed factory activity and export orders weakening across Asia as the impact of the trade war deepened. to the anxiety, Apple Inc AAPL.O on Thursday warned that sales for the holiday quarter would likely miss Wall Street expectations due to macroeconomic weakness in emerging markets including Brazil, Russia, India and Turkey. results could set the tone for equities today," analysts at National Bank of Australia said in a note.

In currency markets, the dollar index .DXY , which tracks the greenback against six major rivals, was up 0.07 percent at 96.344 after a sharp drop on Thursday.

The dollar had fallen across the board, as the pound rallied on reports that London is close to sealing a financial services deal with Brussels, and the Bank of England hinting at slightly faster interest rate rises in future. corrective setup is in place for the for the USD, with overbought valuations and a series of reversals across various currency pairs arguing for a short-term pullback," RBC Capital Markets analysts said in a note.

The pound GBP= fell 0.15 percent to $1.2990.

The weaker dollar also boosted the offshore yuan CNH=D3 , which was at 6.9242 per dollar after touching 6.9800 on Thursday, its weakest level since January 3, 2017.

The dollar rose 0.05 percent against the yen to 112.76 JPY= .

The single currency EUR= was down 0.09 percent on the day at $1.1397.

U.S. crude CLc1 dipped 0.16 percent at $63.59 a barrel. Brent crude LCOc1 was 0.07 percent lower at $72.84 per barrel.

Spot gold XAU= eased slightly to $1,232.71 per ounce. GOL/