* S&P500 E-mini futures down 0.35 pct

* Trump imposes 10 pct tariffs on $200 bln goods from China

By Hideyuki Sano

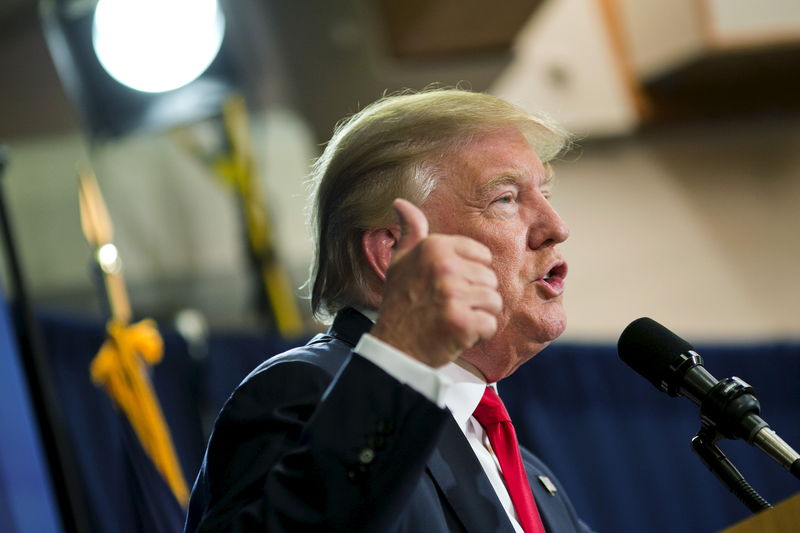

TOKYO, Sept 18 (Reuters) - U.S. stock futures dropped and Asian shares are expected to come under renewed pressure on Tuesday after U.S. President Donald Trump said he will impose 10 percent U.S. tariffs on about $200 billion worth of Chinese imports.

While he spared smart watches from Apple AAPL.O and some other consumer products such as bicycle helmets, he warned that if China takes retaliatory action he will pursue additional tariffs on approximately $267 billion of goods. his latest comments as well as recent falls in his support, it is hard to expect Trump to soften his stance on trade in the near future," said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley (NYSE:MS) Securities.

S&P500 E-mini futures ESc1 dropped 0.35 percent in early trade.

That came after all three major U.S. indexes dropped on Monday, with the tech-heavy Nasdaq posting its biggest percentage loss since late July.

Apple Inc AAPL.O and Amazon.com AMZN.O , the world's top two companies by market capitalisation, fell 2.6 percent and 3.2 percent respectively on worries about new tariffs, which were unveiled after U.S. market close on Monday.

Nikkei futures in Chicago NIYcm1 traded slightly below the contract's close in Japan on Friday. Japanese markets were closed on Monday for a holiday.

In the currency market, the yen gained while the risk-sensitive Australian dollar dropped.

The yen strengthened slightly to 111.74 per dollar JPY= , off Friday's two-month low of 112.175.

The Australian dollar shed 0.4 percent in early trade to $0.7148 AUD=D4 .

The euro stood little changed at $1.1673 EUR= .

The 10-year U.S. Treasuries yield hit a near four-month high of 3.0220 percent on Monday, extending its rise on the back of a recent run of solid U.S. data, before stepping back to 2.994 percent US10YT=RR .

Oil prices also dropped on worries rising trade tension between the U.S. and China could dent global crude demand.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were down 0.5 percent at $68.57 a barrel.