Here’s a simple approach on how to get big dividends of more than 10% forever.

Choose a safe dividend-growth stock Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is a great example of a safe and proven dividend stock that increases its dividend over time. In most years, its earnings are either stable or growing. Consistently growing earnings is a key ingredient for a safe dividend.

The fact that TD maintains a payout ratio of 40% also helps keep the dividend safe in a once-in-a-blue-moon event, such as the financial crisis of 2007-2008.

In fiscal 2008, TD’s adjusted earnings per share fell 15%, but its payout ratio was only pushed to 49%.

From fiscal 2005-2018, TD stock more than tripled its dividend. An investment at the start of the period began with an initial yield of 3.2% but steadily worked its way up to a yield on cost of 10.7% at the end of the period.

Guess what? That yield on cost will only continue to climb higher, and long-term investors will only get bigger dividends on their original investments as TD continues to increase its safe dividend over time.

Buy the dividend stock at a good price Currently, TD stock seems like it’s trading at near its all-time high. Simply look at its price chart below. However, the stock is not expensive and is actually priced at a good valuation.

At $75.40 per share as of writing, the dividend stock trades at a price-to-earnings ratio of about 11.4, while it’s estimated to increase earnings per share at a stable rate of about 6.9% per year. Moreover, TD’s long-term normal multiple is about 12.3. So, the quality dividend stock is trading at a discount.

TD data by YCharts. TD’s long-term stock price chart.

Thomson Reuters has a mean 12-month target of $83.20 per share on the stock, which represents there’s more than 10% near-term upside potential.

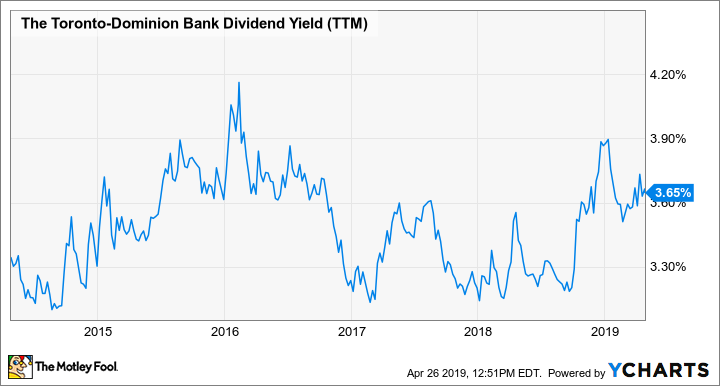

Get a big dividend on the stock from the start By buying TD stock at a good valuation, you’ll get a big dividend on the stock from the start. Currently, the dividend stock offers a yield of about 3.9%.

That’s a big payout compared to what the Canadian market offers — 40% more, to be exact! The dividend yield is also at the high end of the company’s recent yield history.

TD Dividend Yield (TTM) data by YCharts. TD’s five-year dividend yield range.

When will you arrive at a 10% yield on cost? TD forecasts medium-term earnings-per-share growth of 7-10%. Making a low-ball estimate, assuming it increases its dividend by 7% per year, in 14 years, investors will get a yield on cost of more than 10%.

The most exciting thing is that the 10% will eventually turn into 20% (and higher). In fact, it will achieve a yield on cost of more than 20% (specifically, 21.1%) in another 11 years — shorter than the previous 14 years to get to 10%.

The yield on cost will only increase as TD stock continues to increase its dividend over time.

Foolish summary To get big dividends of more than 10% forever, build a diversified portfolio of safe and proven dividend-growth stocks by buying them at good valuations and holding on to them for a long, long time. Your future self will thank your present self. You can start your dividend-growth machine with discounted TD stock today!

Fool contributor Kay Ng owns shares of The Toronto-Dominion Bank.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2019