MUMBAI, Jan 10 (Reuters) - The Indian Commodity Exchange (ICEX) is planning to launch three futures contracts for diamonds in March to provide exporters with a hedging tool, the exchange said on Tuesday.

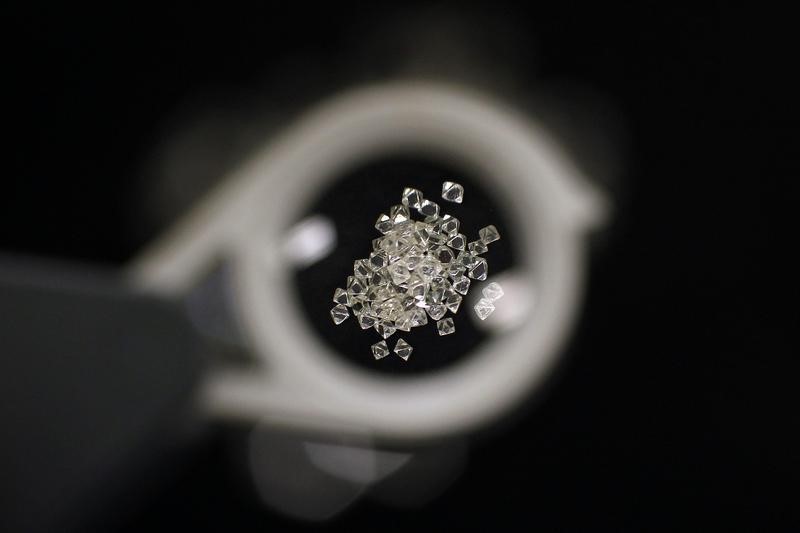

India is a global diamond polishing hub where 14 out of every 15 rough diamonds in the world are polished.

The exchange has received "in-principle" approval from the market regulator Securities and Exchange Board of India (SEBI) to start futures trading and the bourse will initially launch three contracts for stones sized 30 cents, equivalent to 0.3 carats, 50 cents, equivalent to 0.5 carats, and 1 carat, it said.

"The futures contract will enhance the global competitiveness of Indian exporters who will be able to create inventory and hedge against price volatility which will improve price competitiveness," said Sanjit Prasad, managing director of ICEX.

The contracts are designed to consider the requirements of market participants and the delivery centre will be the western Indian city of Surat, which polishes around 80 percent of the world's diamonds, said an official with ICEX, who declined to be named.

India's exports of cut and polished diamonds between April to November jumped by 12.2 percent from a year ago to $15.4 billion, the Gems and Jewellery Export Promotion Council said last month.

However, in the last two months, diamond polishing by small companies has been disrupted due to Indian Prime Minister Narendra Modi's move to abolish most of the nation's cash overnight.