GuruFocus - On June 18, 2024, George Zweier, Vice President and Chief Financial Officer of BRT Apartments Corp (NYSE:BRT), executed a sale of 14,121 shares of the company. According to the SEC Filing, the transaction occurred at an average price of $17.15 per share, totaling approximately $242,174. The insider now owns 113,840 shares of the company.

BRT Apartments Corp is engaged in the ownership, operation, and development of multi-family properties in the United States. The company focuses on properties in regions with strong economic growth and favorable demographics.

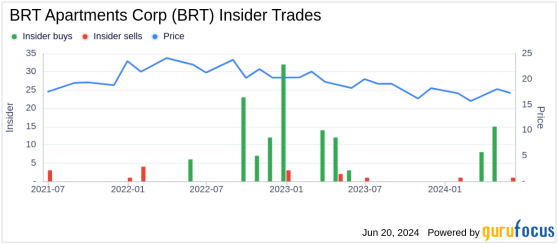

Over the past year, the insider transaction history for BRT Apartments Corp shows a pattern of more insider buys than sells. There have been 23 insider buys and only 4 insider sells during this period.

Shares of BRT Apartments Corp were trading at $17.15 on the day of the transaction, giving the company a market cap of $332.549 million. The price-earnings ratio stands at 81.09, significantly above both the industry median of 17.33 and the companys historical median.

The stocks valuation according to GF Value is $37.46, indicating a price-to-GF-Value ratio of 0.46. This suggests that the stock might be a possible value trap, warranting caution from potential investors.

The GF Value is calculated based on historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, adjusted for the companys past performance and expected future business outcomes.

This sale by the insider might be of interest to current and potential investors, providing insight into the insider's perspective on the stock's current valuation and future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com