GuruFocus - Bryan Anderson, EVP & President of External Affairs at Southern Co (NYSE:SO), sold 6,565 shares of the company on September 6, 2024. The transaction was reported in a recent SEC Filing. Following this transaction, the insider now owns 44,467 shares of Southern Co.

Southern Co, a leading energy company, primarily operates in the electricity market through its subsidiaries. The company is involved in the generation, transmission, and distribution of electricity across various states in the southeastern United States. Southern Co also engages in other energy-related services including natural gas distribution.

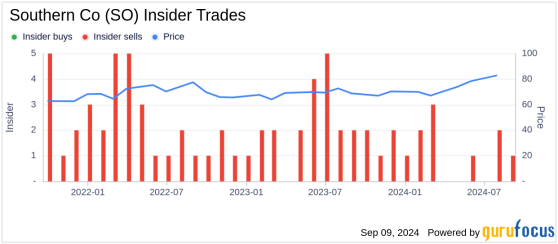

Over the past year, Bryan Anderson has sold a total of 6,565 shares and has not purchased any shares. This recent sale is part of a broader trend observed within Southern Co, where there have been 15 insider sells and no insider buys over the last year.

On the day of the sale, shares of Southern Co were trading at $89.54. This pricing gives the company a market cap of approximately $97.77 billion. The price-earnings ratio of Southern Co stands at 21.32, which is above both the industry median of 14.74 and the company's historical median.

According to the GF Value, the intrinsic value of Southern Co's stock is estimated at $71.22, suggesting that the stock is Modestly Overvalued with a price-to-GF-Value ratio of 1.26.

The GF Value is calculated considering historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, along with a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

This sale by the insider may be of interest to current and potential investors, providing insight into insider confidence and stock valuation perceptions at Southern Co.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This content was originally published on Gurufocus.com