(Adds comment from Dominion; paragraphs 4-7)

By Lawrence Delevingne

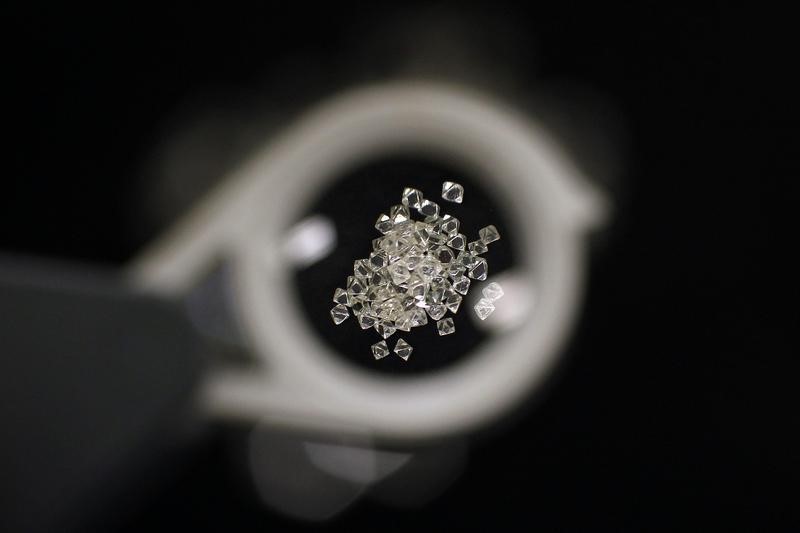

NEW YORK, March 19 (Reuters) - The Washington Companies said on Sunday it had previously made a proposal to acquire all of the outstanding common stock of mining company Dominion Diamond Corp . DDC.TO for $13.50 a share.

The all-cash $1.1 billion offer was sent to the Dominion board of directors on Feb. 21, according to the statement, but subsequent discussions broke down.

"We are disappointed that Dominion's board has thus far prevented Washington from moving ahead with its proposal under which shareholders would receive a substantial premium and immediate liquidity," said Lawrence Simkins, president of Missoula, Montana-based Washington, a group of privately held North American mining, industrial and transportation businesses founded by Dennis Washington.

"We remain fully committed to completing this transaction," Simkins added in the statement.

Yellowknife, Canada-based Dominion said in a statement late on Sunday that its board had considered Washington's unsolicited offer but that the terms of the proposed talks were unusual and unacceptable.

They included, according to the statement, the ability to see confidential information that could later be used for a proxy fight to take over the company, and the ability to veto the board's choice of the new chief executive officer.

"The Dominion Board is more than willing to consider all value-creating opportunities for the Company, but it will not do so to the detriment of its shareholders and other stakeholders," the statement said.

"The Board of Directors reiterates its openness to engage with WashCorps on customary terms," it added.

The offer price of $13.50 represents a 36 percent premium to Dominion's closing stock price on March 17 and a 54 percent premium to the price when discussions ended on March 15, according to Washington.