(Adds capital raise amount, market value; company background)

Sept 27 (Reuters) - Canadian steel producer Stelco Holdings Inc, which emerged from bankruptcy protection three months ago, said on Wednesday it has filed a preliminary prospectus with securities regulators in Canada for a proposed initial public offering of its shares.

Stelco, which is owned by U.S. restructuring firm Bedrock Industries Group LLC, is seeking to raise US$150 million in the share sale and could have a market value of about US$1 billion, according to a source familiar with the situation.

Hamilton, Ontario-based Stelco said in a statement that the number of shares to be sold or their price have not yet been determined. The proceeds would be used for capital investments to develop new products and for early payment to certain pension benefits trusts, Stelco said.

Stelco emerged from nearly three years of bankruptcy protection on June 30 after it was able to extinguish its bloated debt and sign new agreements with its unions. This was its second time in bankruptcy court after it emerged from protection in 2007 when U.S. Steel Corp X.N bought the company for US$1.1 billion.

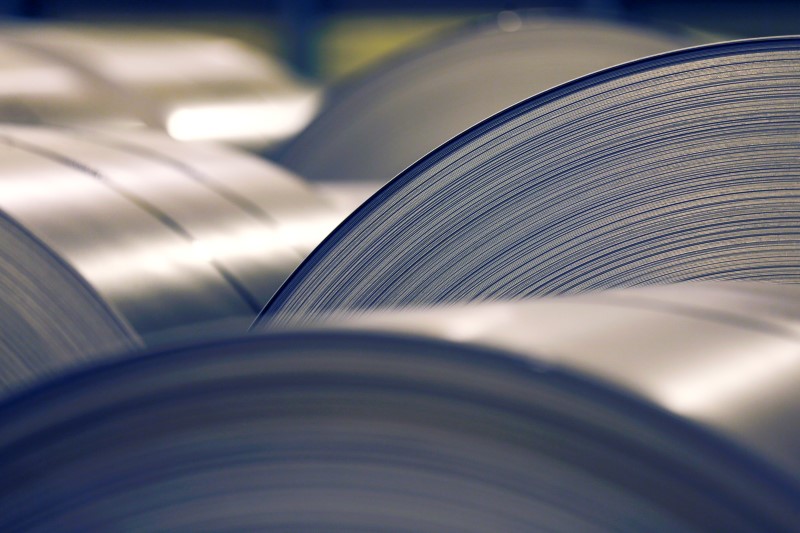

Stelco's revival comes at a time when the United States is considering imposing import tariffs on non-U.S. steelmakers on national security grounds. produces flat-rolled value-added steels for customers in the construction, automotive and energy industries across Canada and the United States. It operates two processing facilities in Ontario.