* Q3 operating loss 31 mln euros vs poll avg loss 32 mln

* Sees 2016 adj EBIT of 200-260 mln euros

* Still waiting for full waste water permit (Adds guidance for 2017 potash output volume, environmental regulator)

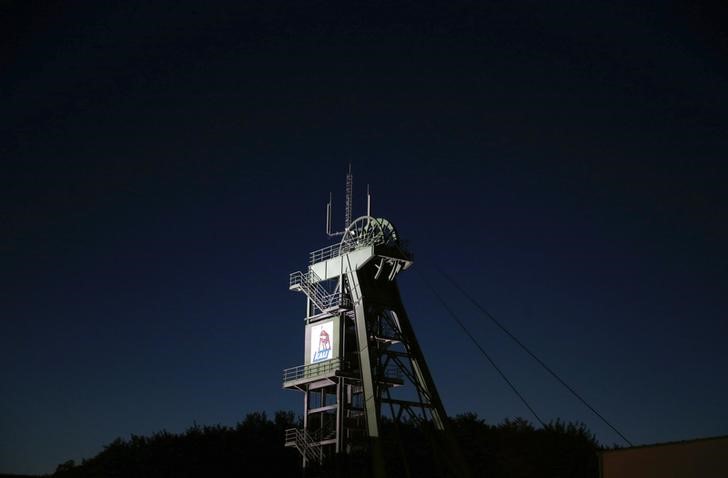

FRANKFURT, Nov 10 (Reuters) - German potash miner K+S SDFGn.DE said it saw 2016 profit at the lower end of its forecast range after swinging to a third-quarter operating loss, hit by lower fertiliser prices, production disruptions and weak demand for de-icing salt.

K+S on Thursday reported a third-quarter loss before interest and tax (EBIT), adjusted for currency hedging effects, of 31 million euros ($34 million), compared with a loss of 32 million euros expected on average by analysts. said it now expected 2016 EBIT of between 200 and 260 million euros in 2016, at the bottom end of a previously stated 200-300 million range and down from 782 million euros last year.

For almost a year, K+S has been operating under a restricted preliminary permit for the disposal of saline waste water in porous layers of rock. The waste water emerges when potash ore is processed into fertiliser products.

As a result, it has been forced to curb production intermittently leading to an estimated 6.1 million tonnes in output of potash products this year, down from the roughly 7 million it can normally extract from its German mines.

The preliminary approval will expire at the end of December but K+S finance chief Burkhard Lohr, who will take over as CEO in May, vowed that 2017 output volumes would rise from this year even if approval for the discharge into porous layers of rock is not renewed at the year-end.

K+S has been working on alternative outlets for the salty water, such as flooding one of its disused mines via rail or truck tankers.

The regional authority that is assessing the environmental burden from waste water said on Thursday it would decide over the next few weeks if and how K+S can proceed. make matters worse, an equipment collapse at K+S's new Canadian potash mine has forced it to postpone the start of production to the second quarter of 2017 instead of at the end of 2016 as originally planned. which last year rejected a takeover approach from larger Canadian rival Potash Corp POT.TO , also confirmed medium-term targets for EBITDA of around 1.6 billion euros in 2020.

($1 = 0.9142 euros)