(Bloomberg) -- The “alpha dog” regulator who spearheaded Washington’s effort to write new rules for Wall Street after the 2008 financial crisis said his successors are making a mess of the road map he left for them.

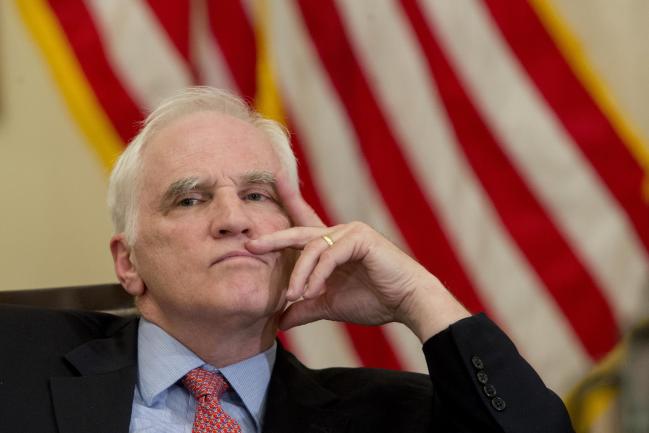

Former Federal Reserve Governor Daniel Tarullo, speaking at an event in Washington on Tuesday, said the agency is engaging in “low-intensity deregulation” that is sometimes easy to miss even as it weakens the banking system’s resiliency. He cited the Fed’s changes to stress testing -- backing off some key requirements while making the process more transparent -- as a prime example of steps to undermine the proposals he laid out as he left the central bank in 2017.

Last year, the Fed proposed integrating Wall Street’s everyday capital demands with each bank’s stress-test results, an idea Tarullo had worked on as far back as 2016. But he told an audience at the Americans for Financial Reform event that the agency’s intent -- “buried in a footnote” -- to discard leverage limits from the new calculations “could result in effectively lowered capital requirements for some of the biggest banks.”

“Capital requirements for the largest banks should be going up, not down,” Tarullo said, countering the view of Fed Vice Chairman for Supervision Randal Quarles, who has said bank capital levels are about right. “Looser bank regulation is always a great temptation. More lending today produces higher growth in the short-term, even if that additional lending is not sustainable.”

Tarullo, who is now teaching at Harvard Law School, also said the Fed’s recent moves to give away more information on the stress tests provides smart bankers “most of what they need” to reverse-engineer the central bank’s models. That allows Wall Street banks to “find clever ways to reshape their assets so as to reduce capital requirements without reducing the riskiness of the assets.”