It’s important for investors to identify quality stocks ahead of time, so they can take advantage of those stocks when they go on sale. I believe Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) and Toronto-Dominion Bank (TSX:TD)(NYSE:TD) are some of the best dividend stocks to buy and hold forever.

Recently, I took advantage of the market correction to buy discounted shares on the dip in December. Some investors end up missing out on buying opportunities because they want to buy at the bottom. The thing is, it’s impossible to catch the bottom; the important thing for the long run is that you actually make stock purchases in quality businesses at discounted valuations.

Here’s proof: In December, I bought shares in both Brookfield Infrastructure and TD Bank, knowing that they were both high-quality stocks and were trading at cheap valuations. I missed the exact bottoms of both stocks. But as of writing, I’m already up 13.8% and 4.7%, respectively, in those shares.

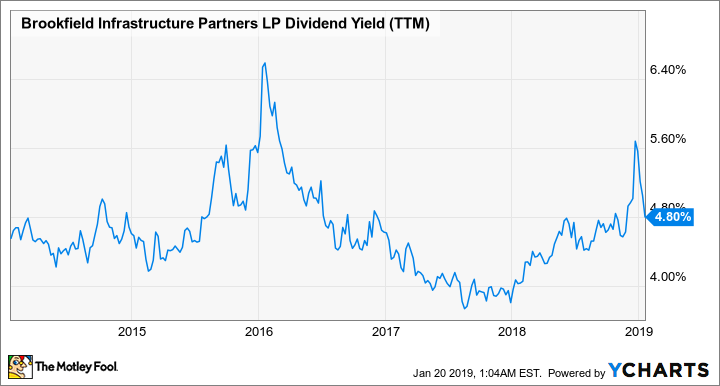

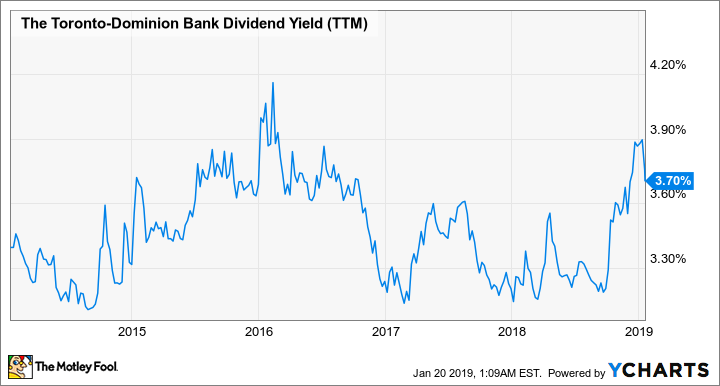

How to tell that the stocks are undervalued For dividend-growth stocks such as Brookfield Infrastructure and TD Bank, the process to tell if they’re undervalued can be as simple as comparing their current yields with their historical yields.

Below is Brookfield Infrastructure’s five-year yield history. The chart indicates that the stock is fairly valued at a yield of about 4.8%. The December correction got the stock to a yield of 5.6%, which was a fabulous buying opportunity!

BIP Dividend Yield (TTM) data by YCharts.

Below is TD Bank’s five-year yield history. The chart indicates that the stock is fairly valued at about a yield of 3.6%. The December correction got the stock to a yield of 3.9%, which was a good buying opportunity.

TD Dividend Yield (TTM) data by YCharts.

Notably, this strategy only works for stocks that offer sustainably growing dividends. I believe both Brookfield Infrastructure and TD Bank will continue to grow their dividends.

How to tell if dividend growth is sustainable If a company has a track record of increasing its dividend for a number of years, there’s a good chance it’ll continue increasing the dividend in the future. The longer the dividend-growth streak, the more likely it’ll continue.

You should also check the payout ratios and balance sheet strength of the company. The lower the payout ratio and the less debt a company has, the more capital it’ll have available for dividend growth.

Brookfield Infrastructure has increased its cash distribution for 11 consecutive years. It targets a funds-from-operations payout ratio of 60-70%, has an investment-grade credit rating of BBB+, and aims to increase its dividend by 5-9% per year.

TD Bank has increased its dividend for eight consecutive years. If it wasn’t for the financial crisis in the last recession, in which it froze its dividend in 2010, its dividend-growth streak would have been much longer. The Big Five banks tend to maintain a payout ratio of under 50%. The good news is that TD Bank’s recent payout ratio of about 40% was relatively low compared to the group.

TD Bank has a high S&P credit rating of AA-. It estimates earnings-per-share growth of 7-10% in the medium term. With a relatively low payout ratio, it has the room to increase its dividend at a faster rate than its earnings growth over the next few years.

Investor takeaway For long-term investing, you don’t need to be too stringent on the buy price. Visualize receiving decades of growing dividend income. Get the compounding machine going by investing in quality dividend-growth stocks today! Within the next two months, I expect both Brookfield Infrastructure and TD Bank to increase their dividends. What’s more to like is that both stocks are still trading at good valuations today.

Fool contributor Kay Ng owns shares of Brookfield Infrastructure Partners and The Toronto-Dominion Bank. Brookfield Infrastructure Partners is a recommendation of Stock Advisor Canada.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2019