(New throughout, updates prices and market activity, adds

details of Draghi press conference, adds comments; changes

byline, dateline, previous LONDON)

* Dollar edges higher; Brent crude tops $48

* European shares add to gains after ECB meeting

* Wall Street gains on earnings

By David Gaffen

NEW YORK, Oct 22 (Reuters) - Stocks rose in the United

States and Europe and the dollar rallied against the euro after

European Central Bank President Mario Draghi said further rate

cuts were considered to stimulate the euro zone economy.

Worries that global economic growth is slowing, particularly

in China, have depressed stock and commodity markets across the

world in recent months and prompted a series of downgrades to

economic forecasts from the International Monetary Fund and

others.

The ECB, as widely expected, took no new steps on Thursday,

but Draghi signaled that it could extend its 1 trillion euro

bond-buying quantitative easing scheme if necessary to combat

weak inflation. ID:nL8N12L31N

"We are ready to act if needed ... and we are open to the

full menu of monetary policy," Draghi said at his press

conference.

Wall Street was higher, gaining ground after the ECB news

and earnings reports that included better-than-expected figures

from McDonald's Corp (N:MCD) MCD.N to weak figures from Caterpillar (N:CAT)

and Raytheon.

A global index of equities .MIWD00000PUS rose 0.7 percent.

The Dow Jones industrial average .DJI rose 215.29 points,

or 1.25 percent, to 17,383.9, the S&P 500 .SPX gained 24.51

points, or 1.21 percent, to 2,043.45 and the Nasdaq Composite

.IXIC added 68.13 points, or 1.41 percent, to 4,908.24.

The dollar edged up against a basket of currencies .DXY .

The U.S. unit has been losing ground in the past month as

expectations waned for an interest rate hike this year by the

Federal Reserve.

The euro EUR= fell 1.5 percent after the ECB decision,

moving sharply lower after Draghi's comments, trading at

$1.1169, a three-week low. It also fell to a one-month low

against sterling. Against the yen, the dollar was up 0.4 percent

to 119.78 yen JPY= .

"Draghi delivered all kinds of dovish signals which weighed

on the euro," said Vassili Serebriakov, currency strategist at

BNP Paribas (PA:BNPP) in New York. "He was as dovish as can be without

changing policy."

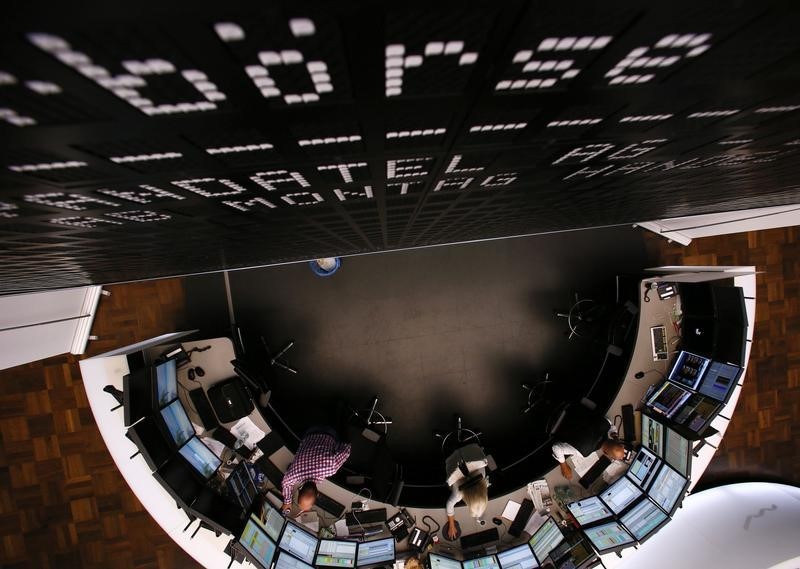

The pan-European FTSEurofirst 300 stocks index .FTEU3 rose

2 percent. An increased full-year sales outlook from Swiss

drugmaker Roche ROG.VX helped support the index. The company's

shares were up 2.8 percent. ID:nL8N12M0FE

Earlier, MSCI's broadest index of Asia-Pacific shares

outside Japan .MIAPJ0000PUS slipped 0.2 percent. Japan's

Nikkei .N225 closed down 0.6 percent.

Euro zone government bonds rallied, with benchmark German

10-year Bund prices DE10YT=TWEB rising 19/32 to drop the yield

to 0.50 percent, down 0.06 percentage point.

U.S. Treasury yields were little changed, with the 10-year

note yield edging up to 2.039 percent. One-month bill yields

rose by 0.03 percentage point to 0.05 percent after the U.S.

Treasury Department said it would postpone a coming two-year

note auction due to uncertainty about whether Congress would

raise the U.S. borrowing limit in a timely fashion.

Oil prices rose slightly after hitting a three-week low on

Wednesday after a larger-than-expected rise in U.S. crude

stocks. Brent LCOc1 , the global benchmark, was last up 36

cents at $48.20 a barrel. U.S. crude rose 29 cents to $45.49 a

barrel.

Gold XAU= held near its lowest in more than a week, last

trading at $1,164 an ounce.