By Marc Jones

LONDON (Reuters) - Shares hit a two-month high and the dollar swooped towards a three-month low on Thursday, after Federal Reserve signals of smaller interest rate rises from next month were followed by the message from Frankfurt that the ECB will plough on.

With Wall Street shut for Thanksgiving, it was up to Europe to continue the rebound in market confidence that has been building for more than a month.

It seemed a bit of a struggle early on when London's FTSE refused to budge, but there were just enough gains in the rest of Europe (EU) and in Asia [.SS][.T] overnight to ensure things kept shuffling forward.

By lunch MSCI's 47-country index of world stocks was at its highest since mid-September, while German and British government bond yields, which drive Europe's borrowing costs, had fallen to their lowest levels since October and September respectively. (EU)

"The Federal Reserve minutes signalled that some sensible voices are trying to drown out Fed Chair Powell’s relentless 'hike, hike, hike' chant," said UBS Chief Economist Paul Donovan.

A "substantial majority" of Fed policymakers had agreed it would "likely soon be appropriate" to slow the pace of interest rate rises, the minutes released on Wednesday showed, although Donovan pointed out that there was no signal of an actual halt yet and various Fed members thought rates might need to go "somewhat higher" than expected.

Futures markets show investors now see U.S. rates peaking just above 5% by May and are pricing in a roughly 75% chance that the Fed now switches to 50 basis point rises rather than the 75 bps it has been using recently.

The ECB's equivalent minutes out on Thursday showed its rate setters fear that inflation may now be getting entrenched in the euro zone.

"Incoming data so far suggest that the room for slowing down the pace of interest rate adjustments remains limited, even as we are approaching estimates of the 'neutral' rate," one of its most influential Executive Board members Isabel Schnabel said separately.

For the currency markets, it meant the 7-week sell-off in the dollar continued. [/FRX]

The euro rose as high as $1.0447, edging it closer to its recent four-month top of $1.0481, while the dollar weakened 0.6% against the Japanese yen to 138.70 yen and past $1.20 against sterling.

"The dollar could stay pressured for a bit longer, but it's probably embedding a good deal of Fed-related negatives now," analysts at ING wrote.

TURKEY ON THANKSGIVING

The Fed wasn't the only focus. Sweden's crown nudged higher as its central bank increased its rates by three-quarters of a percentage point to 2.5% and signalled more next year.

Germany's closely followed Ifo business climate index also rose more than expected, following on from some upbeat data from France too, while Turkey surprised no one as its slashed another 150 bps off its interest rates despite eyewateringly-high inflation of over 85%.

The Turkish central bank said that it marked the end of its cuts, however with presidential elections next year creating doubts about that the lira carved down to new record low.

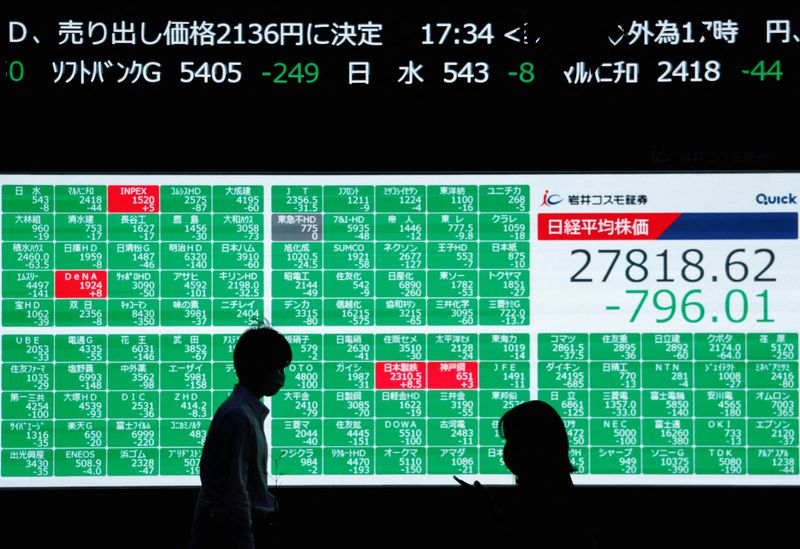

Overnight, Asian markets had seen Japan's Nikkei and South Korean shares both rose around 1%.

The Bank of Korea had reduced its pace of rate increases to 25 basis points. In Japan, data showed manufacturing activity had contracted at its fastest in two years.

Chinese property stocks also stormed nearly 7% higher, after banks there pledged at least $38 billion in fresh credit lines to cash-strapped developers, although the Shanghai Composite Index lost 0.25% as the country's COVID cases continued to surge.

In the oil market, prices were slipping toward a major support level established in September. If they breach it, oil could tumble to levels not seen since before late 2021.

Brent crude futures fell 0.3% to $85.13. U.S. crude oil futures eased 0.2% to $77.74 per barrel. They had tumbled more than 3% on Wednesday as the Group of Seven (G7) nations considered a price cap on Russian oil above the current market level. [O/R]

Recession fears remain intense. Wednesday's post-Fed U.S. bond market moves had seen yields on 10-year notes drop to a huge 79-basis-point deficit relative to two-year yields.

Such a curve inversion has not been seen since the dot-com bust of 2000 and, on the face of it, is a signal that investors expect a deep economic downturn in coming months.