Investing.com-- Most Asian stocks rose on Wednesday, tracking overnight gains on Wall Street as a soft producer inflation reading furthered bets that the Federal Reserve will begin cutting rates from September.

But Chinese stocks lagged their peers, with focus turning to upcoming earnings from some of the country’s biggest firms, due in the coming days.

Regional markets took a positive lead-in from Wall Street, with U.S. stock benchmarks recouping all of last week’s wipeout on positive PPI data.

U.S. stock index futures were flat in Asian trade, with focus turning to upcoming consumer price inflation data from the country for more cues on a September rate cut.

Japan rebound cools, other markets buoyant

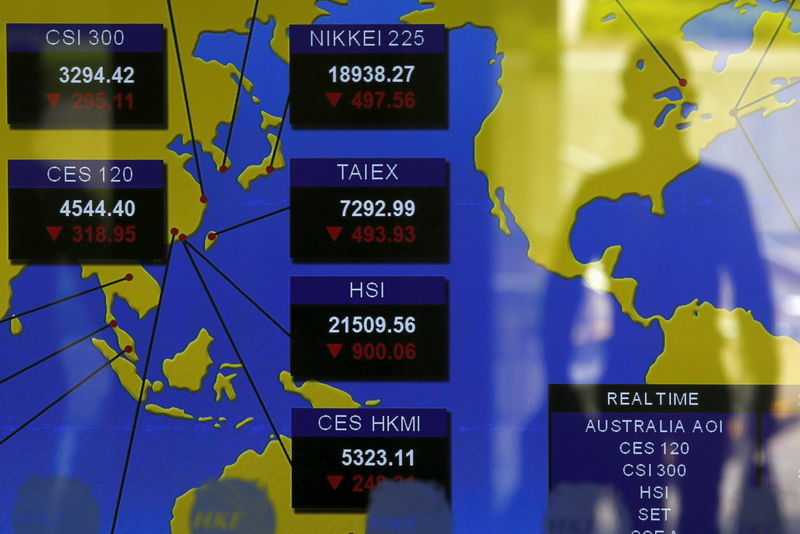

In Asia, Japan’s TOPIX added 0.4%, while the Nikkei 225 fell 0.5% as a rebound in Japanese markets now appeared to be cooling.

Data earlier this week also showed Japanese producer inflation grew as expected in July, pushing up concerns that a sustained increase in inflation will give the Bank of Japan more headroom to hike interest rates.

Focus this week is squarely on gross domestic product data for the second quarter, due on Thursday, which comes after the Japanese economy shrank much more than expected in the first quarter.

Australia’s ASX 200 added 0.7%, with shares of Commonwealth Bank Of Australia (ASX:CBA) rising around 1% after the country’s biggest bank clocked a stronger-than-expected annual cash profit and declared a record-high dividend.

CBA’s big four bank peers also rose, largely offsetting a 4% slide in shares of ASX Ltd (ASX:ASX) after the exchange operator was sued by Australia’s securities regulator.

South Korea’s KOSPI added 0.7%, with local technology stocks tracking an extended rebound in their U.S. peers.

Futures for India’s Nifty 50 index pointed to a weak open, as a growing row between short seller Hindenburg, India’s securities regulator and conglomerate Adani Group dampened sentiment towards Indian markets. Local stocks were also vulnerable to profit-taking.

Chinese stocks lag with major earnings, econ data on tap

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes fell 0.5% and 0.3%, respectively, while Hong Kong’s Hang Seng index shed 0.2%.

Investors were awaiting a string of key earnings from some of China’s biggest firms, which are due in the coming days.

Internet giants Tencent Holdings Ltd (HK:0700) and JD (NASDAQ:JD).com (HK:9618) are set to report their June quarter earnings on Wednesday, as are utilities CK Infrastructure Holdings Ltd (HK:1038) and China Resources Power Holding (HK:0836).

Alibaba Group (HK:9988) (NYSE:BABA), China Unicom Hong Kong Ltd (HK:0762), CK Hutchison Holdings Ltd (HK:0001) and Lenovo Group (HK:0992) are due to report on Thursday. Focus will be squarely on whether Chinese firms were able to weather a decline in local economic conditions.

Beyond the earnings, Chinese industrial production and retail sales data is also on tap this week.