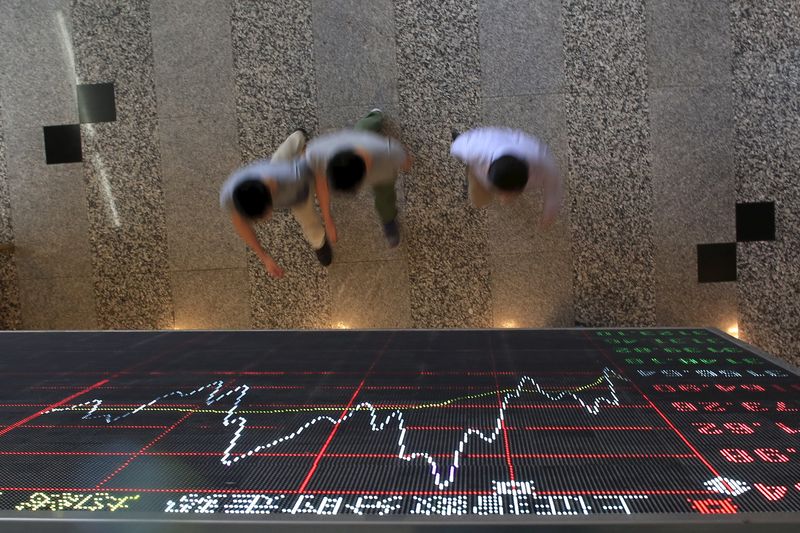

(Bloomberg) -- Chinese technology stocks rallied as Beijing’s renewed vows to step up support for the economy lured back some dip buyers after shares fell near oversold territory.

The Hang Seng Tech Index jumped as much as 5.8% on Tuesday, rebounding from more than a one-month low. E-commerce platform JD (NASDAQ:JD).com Inc. and new-energy vehicle maker XPeng Inc. led the advance, as policy makers promised further support to boost consumption and said they will end the rectification work at major tech companies as soon as possible.

Chinese technology stocks have borne the brunt of selling amid continued concerns over regulatory crackdown, risks of getting delisted from American exchanges, and rising global interest rates. The Hang Seng Tech Index had lost momentum since a brief March rally, and traders will want to see policy promises materialize for the latest rebound to have staying power.

READ: Pessimism Is Everywhere in China Stock Market Amid Lockdown Risk

“It’s a combination of positive news and technicals,” said Billy Leung, a research analyst at Optiver Australia Pty Ltd. The measures “show that the government does not like instability. Technical-wise, we were close to very oversold levels last night.”

The Hang Seng Tech Index’s relative strength gauge fell near 30 on Monday, a level which indicates a security is oversold, Bloomberg data shows. Shares of heavyweights Tencent Holdings (OTC:TCEHY) Ltd. and Alibaba (NYSE:BABA) Group Holding Ltd. have also fallen near that threshold.

With Tuesday’s gains, the tech index has recovered all of its plunge in the previous session. The benchmark Hang Seng Index also advanced as much as 1.9%.

©2022 Bloomberg L.P.