- The percentage of S&P 500 stocks trading above their 200-day moving average has reached a low 36%

- The benchmark stock index has been below its 200-day moving average for five months now—its longest streak since 2009

- Only 28% of NASDAQ Composite stocks are above their 200-EMA

Market breadth refers to how many stocks participate in a given move in an index or on a stock exchange. We can interpret it based on two assumptions:

1. The number of stocks going up relative to the number of stocks going down in an index.

- Positive market breadth: the number of rising stocks is greater than the number of falling stocks. For example: if an index has 60 stocks if 40 are going up and 20 are going down.

- Negative market breadth: the number of stocks going down is greater than the number of stocks going up.

- Neutral market breadth: if the ratio of rising and falling stocks is not substantially different. For example, an index has 100 stocks, 52 are up, and 48 are down.

2. The percentage of stocks in an index trading above their moving averages.

- The lower the percentage of stocks above the 200-day moving average, the weaker the index is.

That is what is happening right now. The percentage of S&P 500 stocks above the 200-day moving average is down to 36%, NASDAQ Composite stocks are down to 28%, and Russell 2000 stocks are down to 29% (in August, the percentage was 86%).

In addition, the S&P 500 has been below its 200-day moving average for five consecutive months now, the longest streak since May 2009.

NASDAQ

Technology stocks have been hit particularly hard in recent weeks, with the NASDAQ Composite losing nearly -10% since mid-August.

Furthermore, U.S. equity funds recorded heavy outflows in the week to September 7. Investors withdrew $14.83 billion in the most significant weekly volume since June 15th.

On the positive side, U.S. fixed income funds recorded inflows of $1.51 billion following two consecutive weeks of redemptions.

Investor Sentiment (AAII)

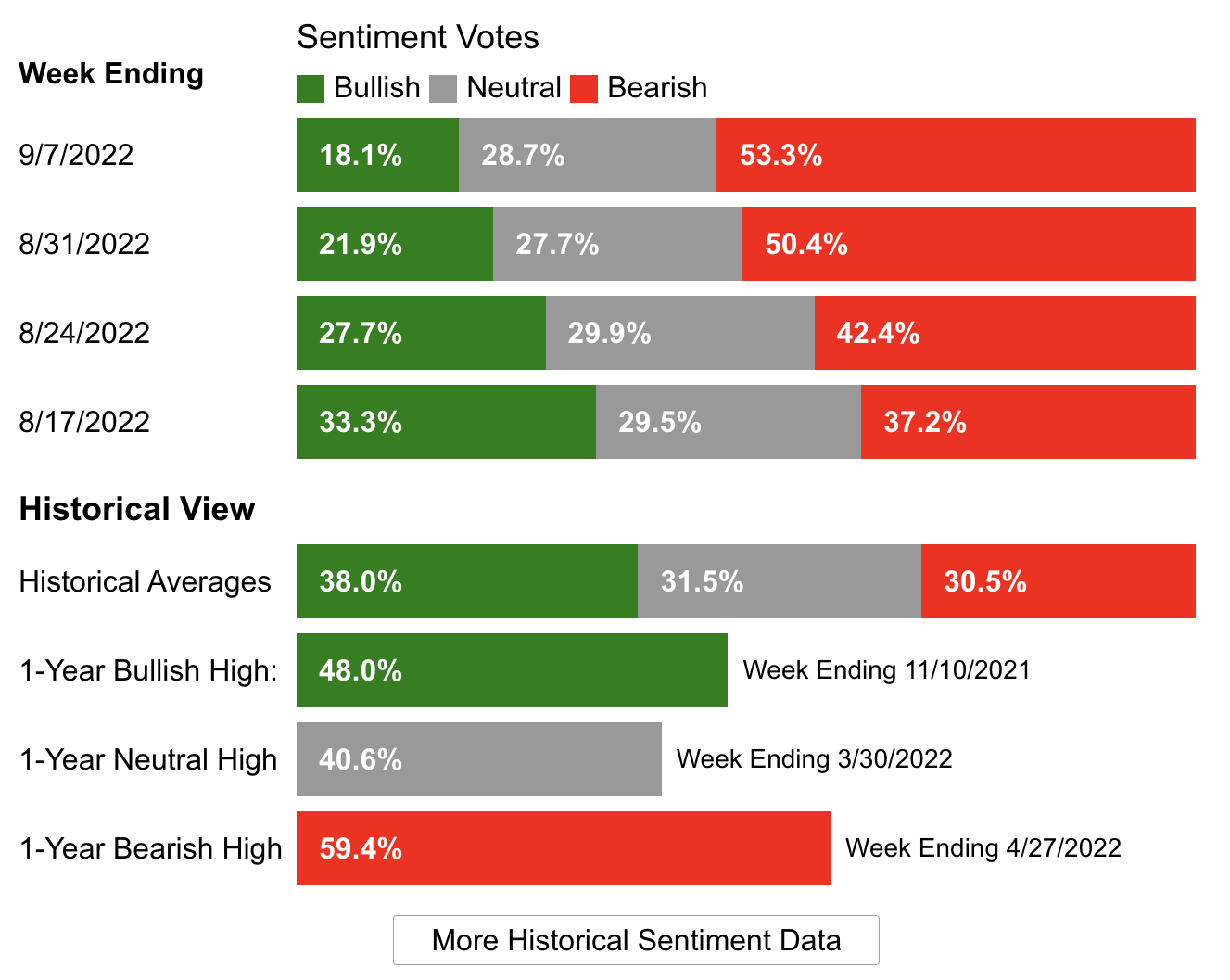

The bullish sentiment (expectations that stocks will rise over the next six months) declined 3.8 percentage points to 18.1% and remained below its historical average of 38%.

The bearish sentiment (expectations that stocks will fall in the next six months) increased 2.9 percentage points to 53.3% and remained above its historical average of 30.5%.

The global stock market ranking so far in 2022 goes as follows:

- Brazilian iBovespa: +9%

- British FTSE: -0.45%

- Japanese Nikkei: -2%

- Spanish IBEX: -7.81%

- Dow Jones Industrial Average: -11.52%

- French CAC: -13.15%

- S&P 500: -14.66%

- Euro Stoxx 50: -16.95%

- Chinese CSI 300: -17.14

- German DAX: -17.61%

- Italian MIB: -19.21%

- NASDAQ: -22.58%

GBP Between A Rock And A Hard Place

The pound sterling continues to depreciate against the US dollar and has already fallen to a level not seen for 37 years.

The Bank of England has now raised rates six times in a row and is expected to deliver yet another 50 to 75 basis points hike on Thursday, September 22nd. Before that, on Wednesday the 14th, we will have the CPI data at 8:00 (in August, it was 10.1%, the highest in the last 40 years).

The chart below shows that the currency is trading right around a major resistance at the 1.1452 zone, which acted very well the last time it was touched, preventing further declines and leading to a good rebound. At the moment, it has come back on September 5th and is bouncing upwards.

Collapse Of The Negative Interest Rate Policy

A few years ago, several central banks engaged in an "experiment" of implementing a negative monetary policy. Specifically, these were the central banks of Denmark, Japan, Switzerland, Sweden, and the European Central Bank.

However, only two still maintain such a policy today: Japan and Switzerland. And while Japan remains reluctant to change its strategy, Switzerland is thinking about it—to which we will get an answer on its Central Bank's next meeting, on September 22nd.

Denmark has been the latest country to get out of this spiral a few days ago, raising interest rates from -0.1% to 0.65%. In this way, they are closing a phase that began ten years ago with the intention that investors would not buy the Danish krone on a massive scale.

Disclosure: The author currently does not own any of the securities mentioned in this article.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.