By Ambar Warrick

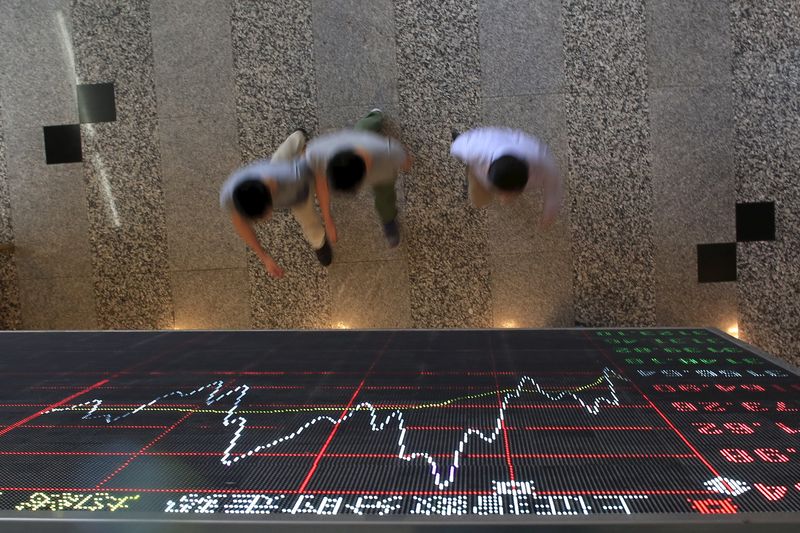

Investing.com -- Most Asian stocks fell on Monday amid renewed concerns over more defaults in U.S. and European banks, with Chinese markets falling the most as weak results pulled oil and gas shares lower.

China’s Shanghai Shenzhen CSI 300 index slid 1%, while the Shanghai Composite fell 1.1%, with energy and chemical companies losing the most on the two indexes. Hong Kong’s Hang Seng index also lost 0.4%.

China Petroleum & Chemical Corp (SS:600028), also known as Sinopec, logged a 6.9% drop in net income for 2022 as a string of anti-COVID measures dented fuel demand. While the firm, which is China’s largest oil and gas company, forecast a recovery in demand this year, economic data from China has painted a mixed picture of a recovery.

Sinopec's Hong Kong (HK:0386) and Shanghai shares both tumbled over 3% each, and were the biggest drags on their respective indexes.

Government data also showed that Chinese industrial profits fell sharply in the year to February, indicating that certain facets of the economy were still struggling even after the lifting of anti-COVID measures.

Broader Asian markets crept lower, with South Korea’s KOSPI down 0.2%, while the Taiwan Weighted index lost 0.3%. Focus remained squarely on more cues from the banking sector, with markets speculating over the next domino to fall among major banks.

Deutsche Bank (ETR:DBKGn), Germany’s largest lender, was hit with a flurry of selling last week after the cost of insuring its bonds against default surged to a near five-year high. This also came amid concerns that regional U.S. banks faced increased deposit outflow risks, as well as a potential breakdown in the real estate market.

Risk-heavy Asian markets faced increased selling pressure in March as a brewing banking crisis weighed heavily on sentiment. While U.S. and European regulators rolled out a slew of measures to calm markets, traders continued to pivot largely out of risk-driven markets.

Still, some Asian markets attempted a comeback on Monday. Japan’s Nikkei 225 index rose 0.4%, helped by recent signals that inflation in the country was easing from over 40-year highs.

India’s Nifty 50 index rose 0.3%, while the BSE Sensex 30 was flat after Jefferies said the country’s stocks could potentially outperform their Asian peers this year.

Australia's ASX 200 index rose 0.1%, as local bank and mining stocks edged higher from recent losses.