* China blue-chips off 3.6 percent

* MSCI Asia Ex-Japan -0.8 pct

* Yuan down on weakest fixing since May 2017

By Andrew Galbraith

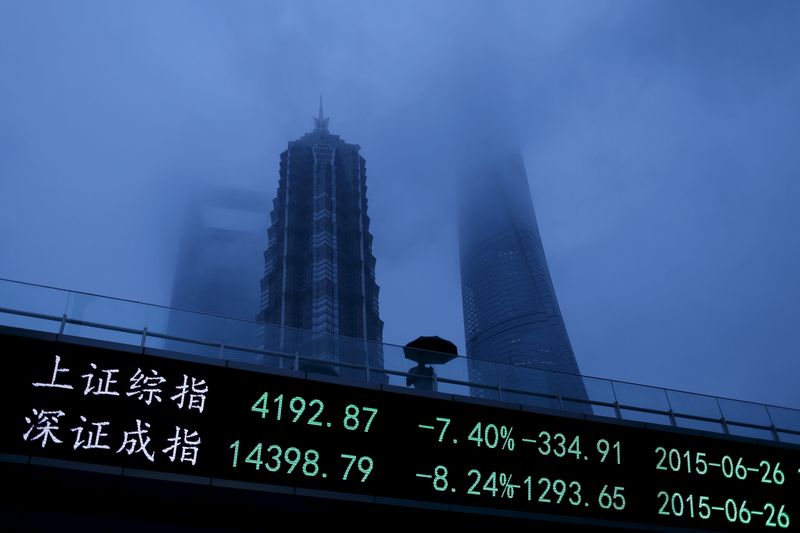

SHANGHAI, Oct 8 (Reuters) - Shares in Asia staggered on Monday as China's markets stumbled despite its central bank moving to pump more liquidity into the broader economy, as worries grow of a sharp knock to growth from an escalating trade dispute with the United States.

The People's Bank of China (PBOC) on Sunday cut the level of cash that banks must hold as reserves, aimed at lowering financing costs as policy makers worry about fallout from the tariff row with the United States.

Reserve requirement ratios (RRRs) - currently 15.5 percent for large commercial lenders and 13.5 percent for smaller banks - would be cut by 100 basis points effective Oct. 15, the PBOC said, matching a similar-sized move in April. shares were also hit on Monday as investors in Chinese stocks reacted for the first time to new pressure from Washington and a report that Chinese spies had compromised U.S. hardware. blue-chip CSI300 index was 3.6 percent lower in morning trade, while the country's main Shanghai Composite Index lost 3 percent. The tech-heavy ChiNext board .CHINEXTP fell 2.9 percent.

"We expect the PBoC will continue its easing efforts to keep liquidity ample and loosen its credit control to make funds more accessible to the broader economy," BofA Merrill Lynch analysts said in a note.

"Moreover, there is still room for further RRR cuts when necessary, though the chance for an interest rate cut is limited given the continued Fed rate hiking cycle, in our view."

On Thursday, U.S. Vice President Mike Pence highlighted disputes with China on issues such as cyber attacks, Taiwan, freedom of the seas and human rights, marking a sharpened U.S. approach toward China beyond a bitter trade war. on Friday, Chinese technology stocks listed in Hong Kong, including Lenovo 0992.HK and ZTE Corp 0763.HK , slumped on a Bloomberg report that the systems of multiple U.S. companies had been compromised by malicious computer chips inserted by Chinese spies. was 1.6 percent lower in Hong Kong on Monday, and ZTE fell 2.5 percent. ZTE's Shenzhen-listed shares 000063.SZ plunged 6.4 percent.

Hong Kong's Hang Seng index .HSI was down 0.9 percent.

The losses in China dragged down MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS , which was 0.8 percent lower.

China's yuan CNY=CFXS was weaker at 6.8979 per U.S. dollar at 0333 GMT, compared with a previous onshore close of 6.8725 per dollar. Earlier on Monday's the PBOC set the midpoint of the yuan's daily trading band CNY=PBOC at 6.8957 per dollar, its weakest level since May 11, 2017.

The offshore yuan CNH=D3 was also weaker at 6.9039 per dollar.

Higher yields on U.S. Treasuries are likely to put more pressure on the yuan as China continues to make use of targeted policy easing to energise the domestic economy.

On Monday, the spread between Chinese and U.S. 10-year Treasury bonds CN10YT=RR US10YT=RR was 58.4 basis points, compared with 150 basis points at the end of 2017.

Equity markets around the world came under pressure last week after a steep sell-off in U.S. Treasuries, prompted by hawkish comments from U.S. Federal Reserve officials and data widely seen as supporting further U.S. rate hikes.

Friday's U.S. non-farm payrolls showed job creation slowed in September, likely from Hurricane Florence's impact on restaurant and retail payrolls, but the Labor Department report also showed a rise in wages that could keep the Federal Reserve on track for more interest rate hikes. are also keeping an eye on Brazil after right-wing Congressman Jair Bolsonaro won nearly half the votes in Brazil's first-round presidential election on Sunday, marking a major shift to the right in Latin America's largest nation fuelled by voters' anger at corruption. currency markets, the dollar was 0.1 percent stronger against the yen at 113.83 JPY= , while the euro EUR= was 0.08 percent weaker against the dollar at $1.1514.

The dollar index .DXY , which tracks the greenback against a basket of six major rivals, was up 0.07 percent at 95.694.

Oil prices fell more than 1 percent after the U.S. said it may grant waivers to sanctions against Iran's oil exports next month, and as Saudi Arabia was said to be replacing any potential shortfall from Iran. crude CLc1 was down 0.8 percent at $73.74 a barrel. Brent crude LCOc1 fell 1.1 percent to $83.25 per barrel.

Spot gold XAU= fell 0.5 percent to $1,196.51 per ounce.

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ MSCI, Nikkei datastream chart

http://reut.rs/2sSBRiD

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>