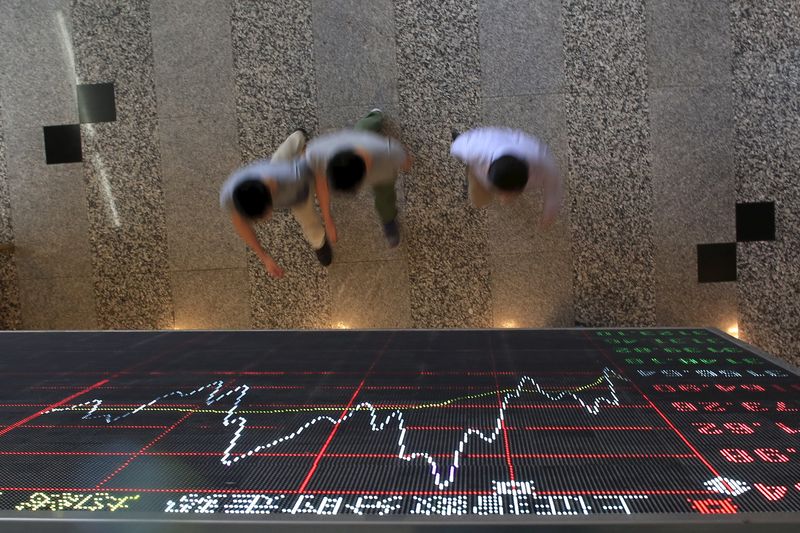

Investing.com-- Most Asian stocks fell on Wednesday, weighed by persistent concerns that sticky inflation will push major central banks into keeping interest rates high for longer.

Chinese markets were somewhat of an exception, advancing slightly after the government announced more measures to support the beleaguered property sector.

Regional stocks took middling overnight cues from Wall Street, which was boosted chiefly by a rally in NVIDIA Corporation (NASDAQ:NVDA), which in turn pushed the NASDAQ Composite to record highs.

But beyond tech, broader U.S. stocks were muted in anticipation of key inflation data due later this week. Federal Reserve officials also kept up their hawkish commentary on interest rates.

U.S. stock index futures were flat in Asian trade.

Australia sinks on inflation shock, RBA jitters

Australia’s ASX 200 index was among the worst performers in Asia, sinking 1% after consumer price index inflation data read stronger than expected for April.

The reading marked a second straight month of increased inflation, and drummed up concerns over a more hawkish Reserve Bank of Australia.

Sticky inflation could push the RBA into keep rates high for longer, or even potentially raising rates further this year, as it moves to bring down inflation.

The central bank had considered a rate hike in its May meeting, and had signaled that it would not rule out any measures to bring down sticky inflation.

Japanese stocks hit by mixed BOJ signals

Japan’s Nikkei 225 index fell 0.3%, while the broader TOPIX index lost 0.5% on Wednesday.

Bank of Japan member Adachi Seiji warned that excessive declines in the yen could attract policy tightening by the central bank, especially if it impacted inflation.

Adachi also forecast that inflation would pick up in the summer-autumn period, and that the BOJ will gradually phase out its stimulative asset purchase programs.

But he warned against any quick increases in interest rates, due to risks to Japan’s economy, and stressed on the need to keep policy accommodative in the near-term.

Broader Asian stocks also retreated, as anticipation of more cues on U.S. inflation and interest rates battered sentiment.

South Korea’s KOSPI fell 0.9%, while futures for India’s Nifty 50 index pointed to a negative open, with the index set for more profit-taking after hitting record highs this week.

Hong Kong's Hang Seng index slid nearly 1% on profit-taking in technology stocks, which offset gains in the property sector.

Chinese stocks rise on more property support

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes were the sole gainers in Asia on Wednesday, rising 0.5% and 0.4%, respectively.

A slew of major Chinese cities, including Shanghai and Shenzhen, were seen further loosening restrictions on home buying and lending requirements for property investment.

The measures come just weeks after Beijing announced a swathe of supportive measures for the property market, a slowdown in which has been a major point of contention for the Chinese economy.